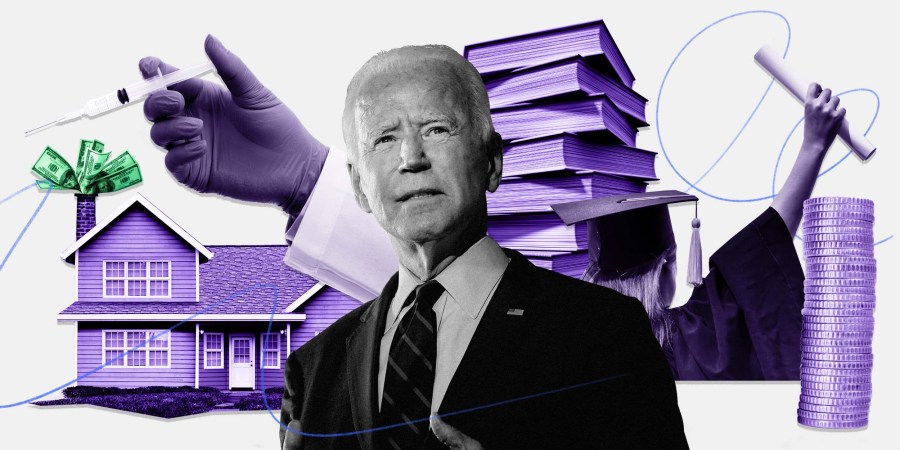

On Friday, the House passed the Build Back Better Act, a spending bill chock-full of progressive priorities, including funding for education, child care, housing, health care and more.

I suspect many people still may not know what’s included in the House bill, so here’s a helpful list of some of the signature provisions. Keep in mind: Some of them will most likely be revised in the Senate to win the support of all 50 Democratic-caucusing senators.

As I said when the infrastructure bill was signed into law: You should feel entitled to partake in spending made possible through your tax dollars and mine. And I, for one, am immune to conservative propaganda suggesting otherwise.

And quick note, y’all: Every year around this time I scroll past stories on how to prepare for heated political debates with your family members. I can’t really relate to that experience, but it seems like a bad way to spend the holiday! Trust me: There’s no sense in arguing over this list. You know very well the people you’re arguing with will gladly accept the benefits outlined here if and when they’re eligible. Just enjoy the food, my friends.

Onward and upward.

Education and child care

The Build Back Better Act includes $380 billion for child care and education. For the next six years, it helps subsidize child care for families, making it free for some of the lowest-income families and caps child care costs at 7 percent of annual income for many other families. It also includes funding to establish free preschool programs for all of America’s 3- and 4-year-olds.

Fighting climate change

The bill contains $555 billion for climate change and clean energy investments, including up to $12,500 in tax incentives for people looking to purchase electric vehicles, as well as incentives for people looking to install solar panels on their homes.

Medicare changes

The bill includes a provision allowing Medicare to negotiate with pharmaceutical companies on a small number of drugs (up to 10), it caps prescription drug costs for seniors at $2,000 per year, and it expands Medicare coverage to include hearing benefits. It also extends tax credits for people buying health care through the Affordable Care Act, and it provides subsidies to help people buy coverage in states that have refused to expand Medicaid through the ACA.

Child tax credit extension

The House bill provides $200 billion to extend the child tax credits first outlined in this year’s American Rescue Plan, the Covid-19 relief package, through 2022. The extended tax credit offers $3,600 in annual tax relief for children 5 years old and younger, and $3,000 in tax relief for children ages 6 through 17. Joint tax filers making up to $150,000 and individual filers making up to $112,500 are eligible for the tax credits.

Paid family and medical leave

The bill sets aside $205 billion to provide all workers with four weeks of paid family and medical leave. The leave is meant for new parents, people tending to serious medical conditions, and people providing care to loved ones with serious medical conditions.