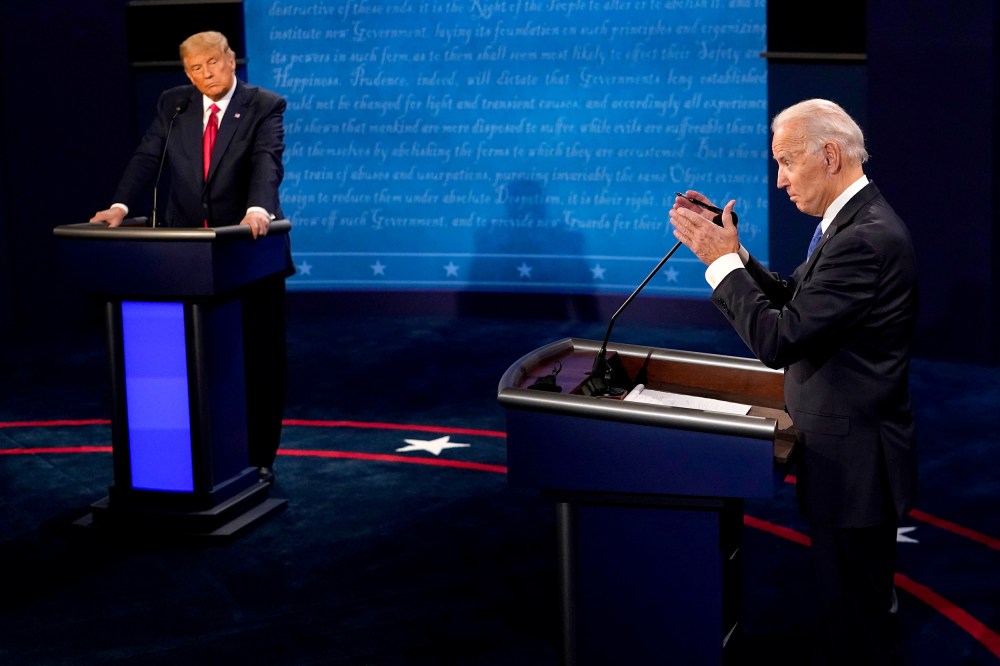

Just two weeks before Election Day 2020, Donald Trump and Joe Biden met for the final debate of the election cycle, and the Democratic challenger pressed the Republican incumbent on a sensitive subject.

“I released all my tax returns. Twenty-two years — go look at them,” Biden said. “You have not released a single solitary year of your tax return. What are you hiding? Why are you unwilling?”

Trump, turning to a familiar talking point, said he was facing an IRS audit, and therefore had to keep the materials hidden from the public. “I’m going to release them as soon as we can,” he added. “I want to do it.”

Even at the time, it was a cynical deception. As the Republican knew, all presidents since Watergate have their tax returns automatically audited by the IRS.

That same policy applies, of course, to President Biden, who released his tax returns to the public yesterday, indifferent to the automatic audit.

Despite the specter of an IRS audit, President Joe Biden and first lady Jill Biden on Monday released their 2020 tax returns. The first couple made just over $600,000 in 2020, and paid $157,414 in federal income tax, the return shows. That’s a federal income tax rate of 25.9 percent. The Bidens also paid $28,794 in income tax in their home state of Delaware, reported donating $30,704 to 10 different charities.

Vice President Kamala Harris and her husband, Douglas Emhoff, also released their tax returns, revising the modern tradition that collapsed between 2017 and 2020.

At yesterday’s press briefing, a reporter asked whether Biden facing an IRS audit affected the decision regarding the release of the tax materials. “No,” White House Press Secretary Jen Psaki replied, “I would expect that we will continue to release the president’s tax returns, as should be expected by every President of the United States.”

Adding to the not-so-subtle messaging, when the White House issued a press release on the disclosure of Biden’s and Harris’ tax returns, the written statement’s first sentence read, “Today, the president released his 2020 federal income tax return, continuing an almost uninterrupted tradition.”