Tipped workers in our country have a serious problem — many of them don’t get paid enough to support themselves or their families. The minimum wage for this group has been mired at the shamefully low level of $2.13 per hour for more than a decade. And they are vulnerable to unscrupulous employers who can steal their tips or allow them to be harassed by entitled customers.

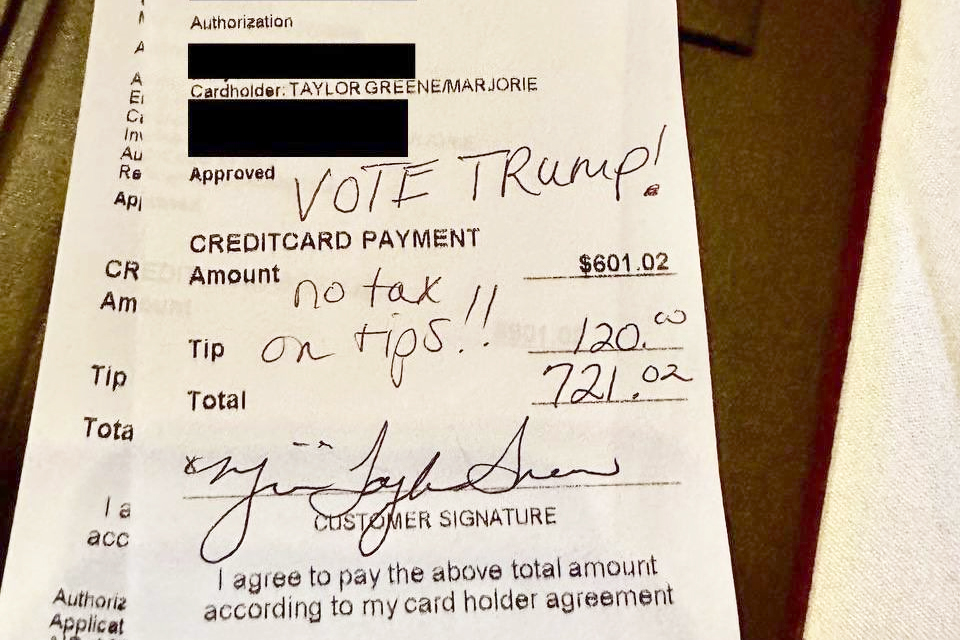

This year’s presidential campaign could be an opportunity for a serious debate over how to solve this problem. And on the surface, it may seem like such a debate is now underway. Unexpectedly, former President Donald Trump has been talking up a proposal that he promises will make tipped workers “very happy” and want to vote for him. He proposes to exempt workers’ tips from federal income taxes. Rep. Marjorie Taylor Green, R-Ga., a loyal Trump ally, seized on this idea, posting a recent receipt with a note she’d left for her server: “Vote Trump! No tax on tips!!” The receipt was seen over 5 million times on X, although it’s unclear whether her call to action has actually sparked a flood of similar campaign doodles.

And that’s good. Because Trump’s proposal, unfortunately, is profoundly unserious.

I absolutely LOVE President Trump’s plan for NO TAX ON TIPS!!

— Marjorie Taylor Greene 🇺🇸 (@mtgreenee) June 15, 2024

Write it on every receipt you sign! pic.twitter.com/BygpUWAunR

The first problem with the Trump proposal is that it would do little to put more money in tipped workers’ pockets. Many tipped workers make too little to owe much or any federal taxes. According to the Bureau of Labor Statistics, the median annual wage for wait staff is only $32,000 per year, which is significant because more than half of all tipped workers are employed by restaurants. Wait staff making that much pay about $1,850 in federal taxes. Tipped workers with at least one child who made only $32,000, however, most likely would be entitled to take an earned income tax credit, reducing their taxes to little or nothing. (Single childless workers are also eligible for this tax credit, but they would need to be earning the low end of the annual wage to qualify.) At its most basic level, the Trump proposal is a mirage for most tipped staff members.

The bigger concern about the Trump proposal is that it could end up harming workers — and creating a new benefit for the corporations who employ them. As the Committee for a Responsible Federal Budget noted: “In practice, exempting tip income from taxation would lead workers and employers to reclassify ordinary income as tip income where possible and could lead to a larger shift toward lower base pay and higher tipped income, more broadly. The magnitude of that behavioral effect is uncertain and would depend significantly on the regulatory guardrails that accompany the policy.”

In other words, it could create an incentive for employers to move more workers from a full hourly wage to the lower tipped minimum wage. That means more workers depending on paychecks that cover only $2.13 per hour and more workers subject to all the uncertainty and exploitation that comes with relying on tips for your income. Who would be sure to end up with more money in their pockets if that happened? The owners and shareholders of companies taking advantage of a new tax loophole.

The real tell that Trump isn’t serious about improving the lives of tipped workers is his record of opposing the policies that we know would actually help them.

The real tell that Trump isn’t serious about improving the lives of tipped workers is his record of opposing the policies that we know would actually help them. There is a clear agenda for advancing the economic interests of tipped workers. The Trump administration, however, fought every element of that agenda.