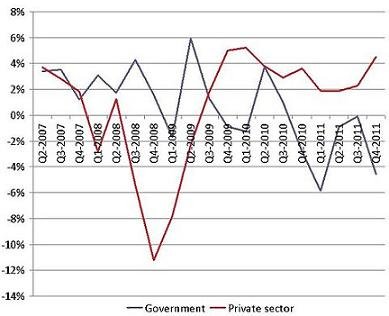

The New York Times’ David Leonhardt posted this rather remarkable chart the other day, pointing to two countervailing economic forces: the public sector and the private sector. In the image, the blue line shows government growth, while the red line reflects growth among businesses.

The chart paints quite a picture. As the severity of the Great Recession took its toll in 2008 and 2009, private-sector growth simply collapsed, though it’s clearly recovered since. But also note that blue line — as local, state, and federal officials have cut spending, public-sector growth has fallen.

The result is a problematic dynamic that’s entirely avoidable: we’re trying a stimulus and a counter-stimulus in response to the same economic conditions. As Leonhardt explained:

The private sector began to recover in 2009. The recovery slowed in 2010 and again in 2011, as the dips in the red line show. But by the end of last year, the private sector was expanding at a healthy 4.5 percent annualized pace.

Why, then, wasn’t economic growth in the most recent quarter better than the 2.8 percent that the Commerce Department reported today?

Because the economy is the combination of the private and public sectors. The public sector has been shrinking for the last year and a half — mostly because of cuts in state and local government, with some federal cuts, especially to the military, playing a role as well. In the fourth quarter, government shrank at an annual rate of 4.5 percent.