The point of the Consumer Financial Protection Bureau is pretty easy to figure out: the agency’s name offers a pretty big hint. The CFPB was created to protect consumers’ interests against unfair financial industry practices.

At least, that was its intended purpose. As Slate noted the other day, the bureau’s mission statement has received a Trumpian makeover.

The latest is the Consumer Financial Protection Bureau, the crisis-era creation of Sen. Elizabeth Warren charged with investigating the deceptive practices of lenders, wire services, auto dealers, credit card companies, and so on. The banking watchdog’s mission statement now lists its first order of business as hunting down “outdated, unnecessary, or unduly burdensome regulations.”

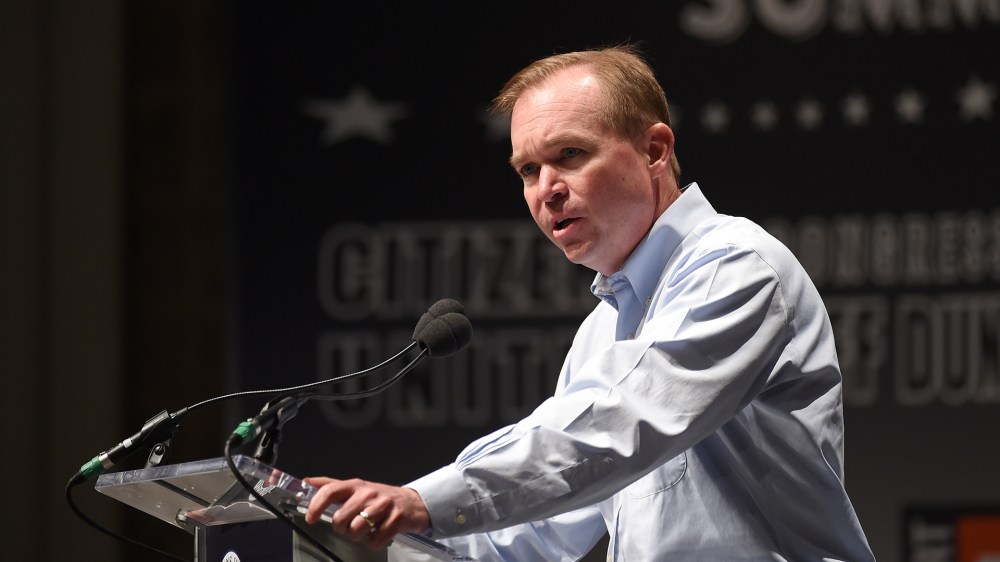

Slate has reached out to the CFPB for comment, but the change can likely be traced to the arrival of Acting Director Mick Mulvaney, who took over the CFPB on Nov. 27. The South Carolina Republican is also the director of Trump’s Office of Management and Budget, and as the Intercept’s Dave Dayen reports, has quickly moved to fill the ranks of the CFPB with Trump loyalists.

Mulvaney, as regular readers know, has repeatedly and publicly condemned the existence of the CFPB, which the president asked him to lead, and which he’s dramatically changing the direction of.

This is, of course, an important piece to a larger puzzle: when given opportunities to champion the interests of consumers and working families, Trump always seems to do the opposite.

The New York Times had a good piece along these lines two weeks ago, before the CFPB changed its mission statement in a more bank-friendly way.

[T]his week, the president hopes to sign with great fanfare a tax bill that would deliver its largest benefits, not only in dollar terms but also as a percentage increase in income, to corporations and the wealthiest Americans. […]