It’s rare when a series of errors in an economic paper generate national attention. Then again, it’s rare when an economic paper does as much as damage as the report Carmen Reinhart and Kenneth Rogoff published a few years ago.

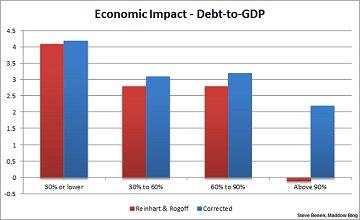

By now, you’re probably familiar with the story. The Reinhardt/Rogoff study effectively made a straightforward observation: there’s not only a relationship between a nation’s debt level and its GDP, there’s also a tipping point. When a nation’s debt climbs above 90% of the nation’s total economy, it necessarily serves as a drag on economic growth.

The Reinhardt/Rogoff study was immediately embraced by Republican policymaker at the highest levels, and became the intellectual foundation for a destructive austerity agenda.

The problem, we now know, is that Reinhart and Rogoff made some important errors in their research, including a careless mistake in an Excel spreadsheet. The economic research embraced by conservatives everywhere was faulty, and a national controversy ensued — including a brutal segment on “The Colbert Report.”

Reinhart and Rogoff, hoping to stem the tide of criticism, published an item last week defending their work. The response was unkind — Paul Krugman described their defense as “really, really bad” and “terrible.”

So today Reinhart and Rogoff try again, writing an item for the New York Times. The gist of the piece is that their error-laden study was misused by partisan opportunists on the right and therefore not entirely their fault.

Nowhere did we assert that 90 percent was a magic threshold that transforms outcomes, as conservative politicians have suggested. […]

Our view has always been that causality runs in both directions, and that there is no rule that applies across all times and places…. Our consistent advice has been to avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists.

Or put another way, “Who, us? Tipping point? 90%? This has been a big misunderstanding!”