It’s easy for many to forget, but when President Obama and congressional Democrats approved the Recovery Act — better known at the time as the Dems’ “stimulus” package — they didn’t just rescue the economy from the Great Recession. In the process, they also passed one of the largest middle-class tax cuts in recent memory.

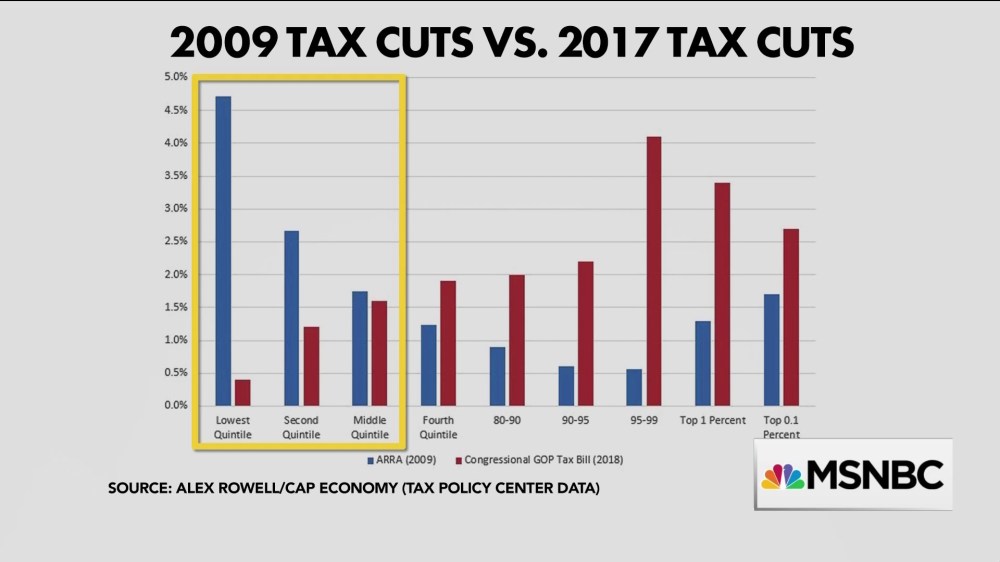

Roughly a third of the Recovery Act went toward direct investment, a third went to assist states, and a third went to cut taxes — with a special emphasis on working families. In fact, MSNBC’s Chris Hayes featured the above chart on his show this week, and highlighted a fascinating detail:

“Here’s the thing about that stimulus bill: it included substantial tax cuts for middle-class and working-class families. For most people — listen to this — the bottom three-fifths of earners, those tax cuts that were in the much-hated ‘stimulus’ were bigger than what is in the current Republican bill that got passed today.”

This has the benefit of being completely true. While the Republican plan, when fully implemented, would raise taxes on the bottom 60% of Americans, next year, those same folks in the bottom three-fifths will get a small tax cut.

It just won’t be as big as the tax cut Obama and congressional Democrats delivered in 2009. (And unlike Trump’s plan, the Recovery Act didn’t feature a middle-class tax increase down the road.)

This came to mind the other day when Gary Cohn, the chief economic adviser in Trump’s White House, reportedly told Axios, in reference to the Republican tax plan, “We did not set out to give the wealthy a tax cut.” Cohn made a similar comment recently to CNBC, saying before the plan passed Congress, “I don’t believe that we’ve set out to create a tax cut for the wealthy.”