One of the driving criticisms of Paul Ryan’s House Republican Budget is a familiar refrain: his numbers don’t add up. But the criticism almost gives Ryan too much credit — it assumes there are enough numbers in the far-right plan to evaluate whether it adds up, when there really aren’t.

Take the biggest question mark hanging over Ryan’s blueprint: his plan for massive tax breaks, lowering the top rate from 39.6% to 25%, to be paid for with “tax reform.” How would the latter pay for the former? The Wisconsin congressman doesn’t say, but there’s an even more pressing question: how much would these enormous tax cuts cost?

The non-partisan Tax Policy Center ran the numbers that provided a figure Ryan didn’t want to include in his own budget: “The Tax Policy Center estimates that cutting individual rates to 10 percent and 25 percent, repealing the Alternative Minimum Tax and the tax increases included in the Affordable Care Act, and cutting the corporate rate from 35 percent to 25 percent would add $5.7 trillion to the deficit over the next decade.”

Let’s be clear about the fiscal implications. Ryan wants to cut taxes by $5.7 trillion over the next 10 years, which means he’d need to find another $5.7 trillion — somewhere, somehow — just to break even. In other words, all of this would have to work out before Republicans could even try to bring down the deficit by so much as a penny.

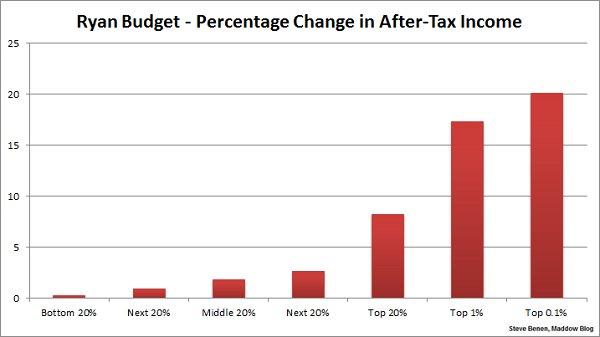

What’s more, it’s important to consider the winners and losers under such a plan. The Tax Policy Center showed the impact by public quintile, and wouldn’t you know it, the rich benefit far more than the poor — and this doesn’t even consider the impact felt by Ryan’s intentions to slash public benefits that benefit working families most.