Democratic leaders continue to support an ambitious economic aid package, but they’re eager to deal. A bi-partisan group — technically, a tri-partisan group — of senators yesterday unveiled an underwhelming package of their own in the hopes of breaking the logjam.

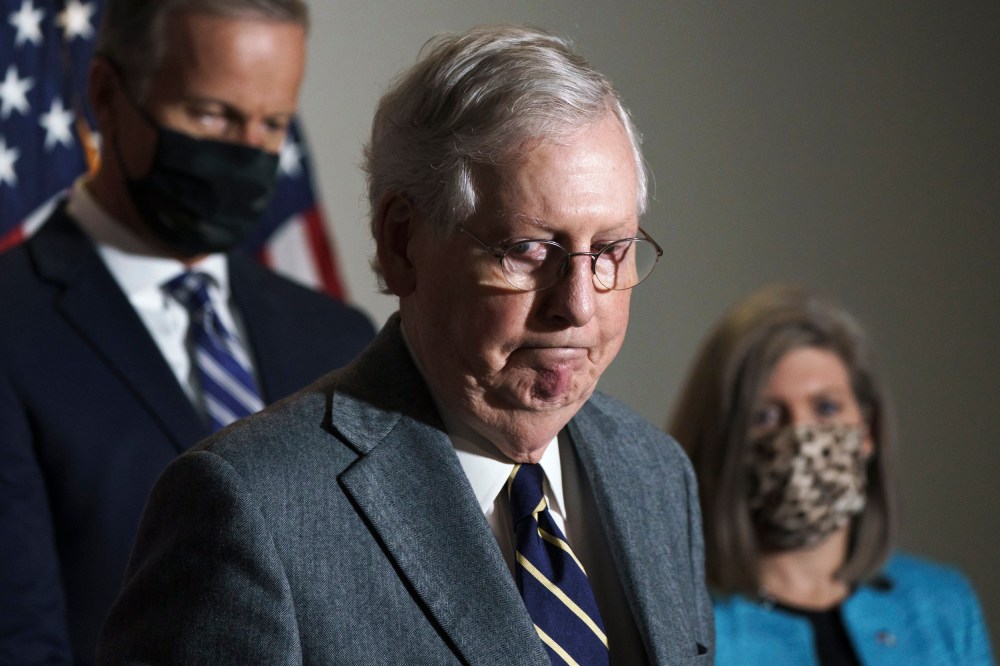

And there’s Senate Majority Leader Mitch McConnell (R-Ky.), who’s sticking to a $500 billion blueprint — roughly a fourth of the House Democratic proposal, and roughly half of the “moderate” plan unveiled yesterday — which contains “no funding for state and local aid, no money for rental assistance, and provides just a one-month extension of unemployment benefits rather than the bipartisan proposal’s three-month extension.”

McConnell’s plan also offers nothing in the form of food/nutrition assistance, and does not extend an evictions moratorium.

It does, however, include a provision popularly known as the “three-martini-lunch deduction.” The Washington Post reported:

The McConnell bill also reintroduces a Republican plan to allow diners to claim a tax deduction on their meal expenditures, a provision pushed by the business lobby but viewed skeptically by economists and some Republicans.

Circling back to our coverage from the summer, it was Donald Trump who helped get the ball rolling on this in April and May, pushing lawmakers to approve “business deductions” for “restaurants & entertainment.”

At face value, the idea may not seem outlandish. After all, the restaurant industry has been brutally slammed by the pandemic, and it’s hardly unreasonable for policymakers to look for ways to give the industry a boost.

But the details matter. At issue here is a tax break to those who talk business while eating out. As the Center on Budget and Policy Priorities’ Robert Greenstein noted a while back, the “three-martini-lunch deduction” is generally celebrated by wealthy executives and lobbyists.