At first blush, the Republicans’ push for massive tax breaks, disproportionately benefiting the wealthy, seems politically unwise. The American mainstream isn’t exactly clamoring for the GOP tax plan — polls show broad public opposition to the Republican proposal — and no party ever became more popular by doing something unpopular.

What’s more, the country can’t afford the Republican plan; there’s no reason to believe it’d make a significant difference on the economy; and it’s having the unintended effect of dividing the GOP at a difficult time.

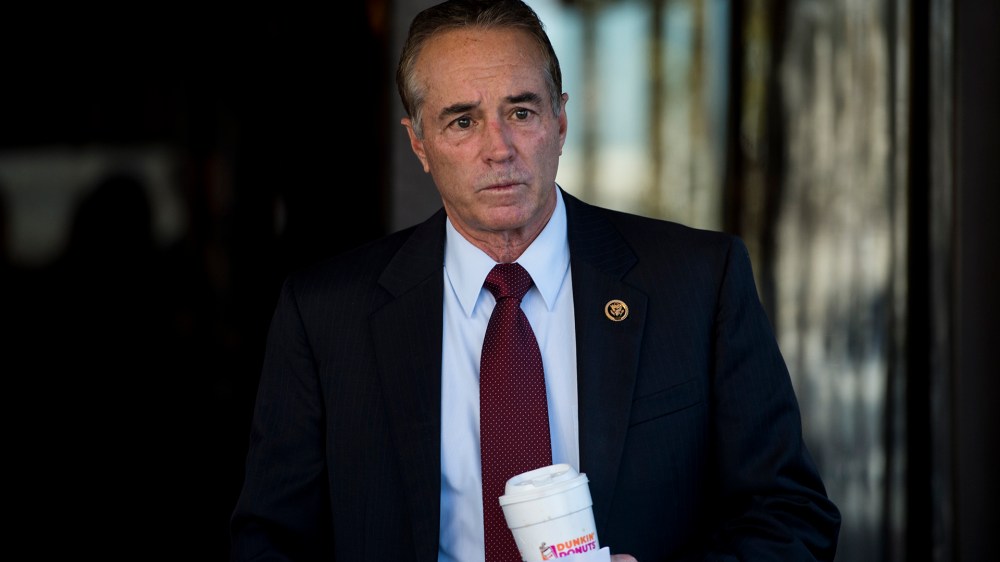

So why focus so much time, energy, and resources in the idea? Rep. Chris Collins (R-N.Y.) spoke to The Hill this morning and gave away the game.

A House Republican lawmaker acknowledged on Tuesday that he’s facing pressure from donors to ensure the GOP tax-reform proposal gets done.

Rep. Chris Collins (R-N.Y.) had been describing the flurry of lobbying from special interests seeking to protect favored tax provisions when a reporter asked if donors are happy with the tax-reform proposal.

“My donors are basically saying, ‘Get it done or don’t ever call me again,’ ” Collins replied.

I suppose Collins deserves some credit for being so publicly candid. Traditionally, members of Congress have been more restrained when talking about using their offices to pursue political donors’ goals, but Collins, a prominent Donald Trump ally, is taking a refreshing approach. He’s admitting that he’s concerned about the pressure he’s under from campaign contributors.