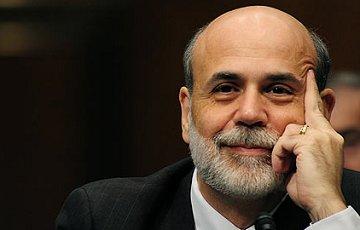

If you like the status quo in U.S. monetary policy, you’ll enjoy Federal Reserve Chairman Ben Bernanke’s latest announcement.

The U.S. Federal Reserve stuck to its plan to buy $85 billion in bonds each month to push down borrowing costs and prop up the economy, citing risks to growth from recent budget tightening in Washington.

Describing the economy as expanding moderately in a statement that largely mirrored its March decision, Fed officials cited continued improvement in labor market conditions.

But they reiterated that unemployment is still too high for policymakers’ comfort, reinforcing their desire to keep buying assets until the outlook for jobs improves substantially.

The key takeaway from the Fed’s policy statement, at least to me, came in these six words: “Fiscal policy is restraining economic growth.”

Let’s translate that: government spending cuts are hurting the economy.