President Obama is pushing a modest, popular tax plan: those making under $250,000 get to keep their tax cut for another year. The top 2% get to keep their tax cut for their first $250,000 in income, but would pay Clinton-era rates on the rest.

How will Mitt Romney fight against a middle-class tax cut in an election year? By labeling Obama’s plan “extreme.”

Mitt Romney on Tuesday branded President Obama’s tax plan as an “extreme liberal” position that would halt job creation. […]

“The very idea of raising taxes on small businesses and job creators at the time we need to create more jobs could is the sort of thing only an extreme liberal could come up with,” Romney said.

Let’s unpack this a bit because it’s a pretty important part of the presidential race.

We know, for example, that for any fair-minded person to characterize Obama’s plan as “extreme” liberalism is demonstrably ridiculous. We also know that if anyone’s plan is going to qualify as “extreme,” it’s Romney’s.

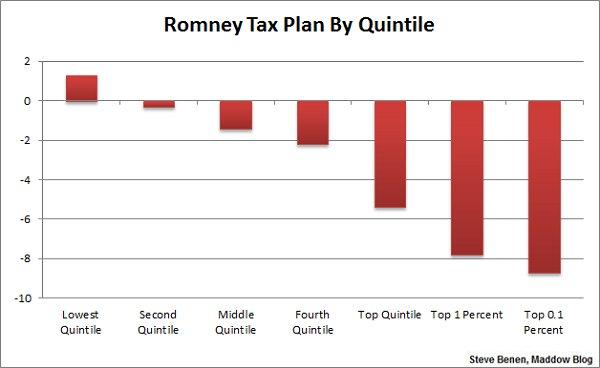

When Romney first unveiled his tax plan in the Spring, the non-partisan Tax Policy Center published a fairly detailed analysis, showing that the Republican’s proposal would raise taxes on those struggling most, while delivering more huge tax breaks for the wealthy — a Bush/Cheney plan on steroids.

Now, in fairness, Team Romney has said the TPC analysis is mistaken, because it doesn’t include various incentives and deductions that the Republican administration would support. But given that Romney refuses to tell anyone what those details might look like, we can only scrutinize the policy the way it currently looks on the page. (Derek Thompson noted a related analysis yesterday that suggests even more Americans would face a tax increase under Romney’s plan.)

What’s more, if we ignore Romney’s vague plan and look only at the Paul Ryan budget plan that Romney endorsed, the tax changes are more extreme, not less.