President Donald Trump received a long-awaited gift from America’s central bank today: lower interest rates for the second consecutive month.

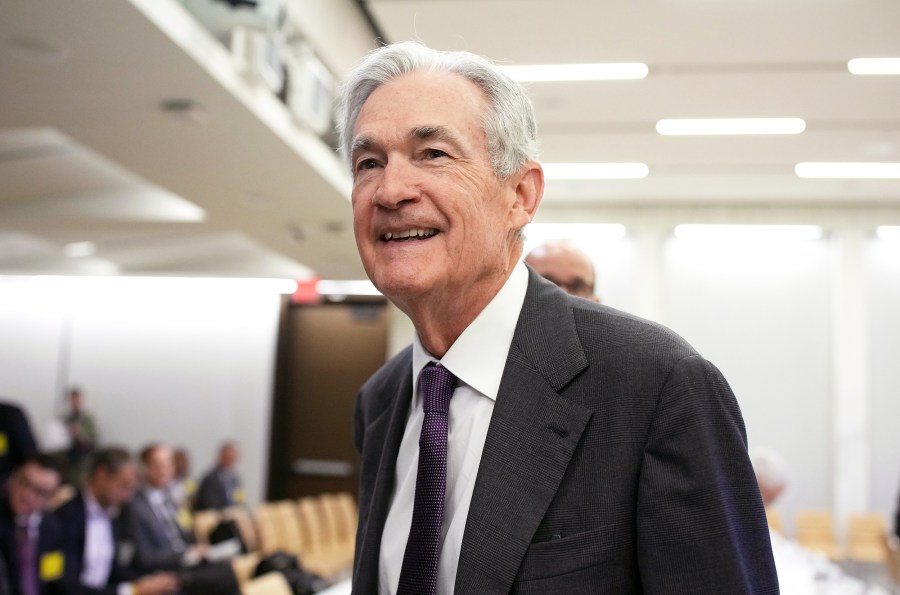

The news was delivered by one of the public officials he has most villainized throughout the course of both of his presidencies: Federal Reserve Chair Jerome Powell, whom he appointed in 2017.

Trump lambasted Powell this week, calling him “Jerome ‘Too Late’ Powell” in a speech to Asian business leaders in South Korea. “We’re not going to have a Fed that’s going to raise interest rates because they’re worried about inflation in three years from now,” Trump added.

It’s unclear if Trump’s rhetoric about Powell will change now that the Fed has shifted course from leaving rates unchanged. On Tuesday, the central bank’s governors voted to lower rates by 25 basis points.

“The Federal Reserve’s much-needed interest rate cut only highlights how destructive the Democrat Government Shutdown is — with key government economic data releases delayed potentially indefinitely, the Federal Reserve is flying blind heading into its next meeting in December. As are the businesses, families, investors, and markets who rely on reliable and timely government data,” White House spokesperson Kush Desai said in a statement.

Trump has frequently taken aim at the Federal Reserve chief for holding steady on interest rates as inflation continues to dog the economy — threatening to fire him and then backing off. He is actively seeking a new Fed chair to appoint once Powell’s term as chairman expires in May, engaging in an unusually public search for a replacement.

The personal animus continued during Trump’s swing this week through Asia.

“We have a person that’s not at all smart right now,” Trump told reporters aboard Air Force One on Monday about Powell. “He should have been much lower, much sooner.”

Trump lambasted the Federal Reserve chair this week, calling him “Jerome ‘Too Late’ Powell” in a speech to Asian business leaders in South Korea.

The last time the Federal Reserve dropped its funds rate was in 2024, in a series of decisions that Trump has described — without evidence — as politically motivated, coming both before and after his election.

Now that the president got his wish of lower borrowing costs, economists say it’s unlikely to deliver immediate relief. Although a key inflation reading turned out to be lower than expected last week, it was still above the Fed’s 2% target, coming in a full point higher at 3%. Enduring inflation has remained a thorny issue for Trump, running counter to his campaign vows to lower the cost of living for Americans while he is in office.

A majority of Americans, 74%, say that economic conditions are only “fair” or “poor,” according to a recent survey from Pew Research Center, including more than half of Republicans and 90% of Democratic respondents.

William Yu, an economist at the University of California, Los Angeles, said the Fed is responding to “a problem” in the economy, specifically weak labor and housing markets. Cutting the federal funds rate is the “right decision,” Yu said.

The Labor Department has yet to release its official monthly jobs report due to the ongoing government shutdown in Washington, D.C., but forecasters say the downward trend of recent months is likely to continue.

Multiple corporate giants, including Amazon, Target and United Parcel Service, announced massive layoffs this week. Meanwhile, Meta, the owner of Facebook, and Rivian, an electric-vehicle company, said they also cut about 600 jobs each. In August, unemployment rose to 4.3% for the first time since October 2021. Previously, data showing a strong job market and stubborn inflation kept interest rates near their highest levels in more than a decade.

Typically, a downward adjustment is a sign that the board wants to encourage economic growth.

“I don’t think it will change the trajectory of the economy all that much,” said Josh Bivens, chief economist at the progressive-leaning Economic Policy Institute. Cuts “will not be any kind of game changer in the near term.”

Bivens, like other analysts interviewed by MSNBC, said he believes that the White House’s tariff policies are pushing prices higher. Five Senate Republicans on Tuesday voted to block Trump’s duty on Brazil in a rare rebuke of the president. Those levies, Biven said, are more likely to continue to drive costs going into next year, rather than the federal funds rate.

Yu also expressed skepticism that interest range changes will have a sizable impact on inflation, though for different reasons, including increased costs for rent, insurance premiums and medical expenses. “That is totally different, totally unrelated to monetary policy,” he said. Still, the California-based professor sees bright spots, including positive expectations for gross domestic product in the third quarter.