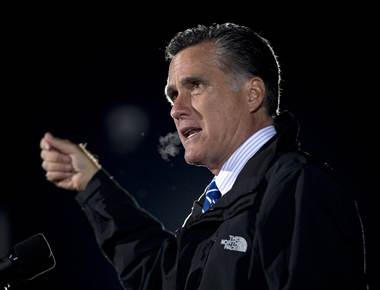

Turning Medicare into a voucher program, as Mitt Romney wants to do, would raise costs for most beneficiaries, a nonpartisan report recently found. But health care experts say that’s not the only downside to the scheme: It could also cause chaos for seniors.

In his budgets, Paul Ryan has proposed replacing Medicare with vouchers that seniors could use to buy health insurance. A newer version of Ryan’s voucher plan—which Romney endorsed before he had even put Ryan on the ticket—would also keep traditional Medicare as an option. Under the plan, the government would receive bids from insurance companies in each region, and pay “premium support” subsidies at the rate of the second-cheapest private plan bid, or Medicare, whichever is lower.

A study released last week by the nonpartisan Kaiser Family Foundation, which looked at a Medicare voucher program similar to Romney-Ryan’s, found that 59% of Medicare beneficiaries would pay more under that system, because they’d be in plans that cost more than the benchmark plan in their area. “On average, private plan enrollees would pay $87 per month ($1,044 per year) in additional Medicare premiums,” Kaiser found.

But that’s not the only downside. The authors of the report told msnbc.com that such a scheme could open up a Pandora’s Box of confusion for many seniors, who may not have the ability to navigate the often complex new system of choices available to them.

Here’s why: Currently, any senior or qualifying person with disabilities can just automatically enroll in traditional Medicare. They only have to consider a menu of private plans through Medicare Advantage if they choose to go that route. Under Romney-Ryan, that would no longer be the case. Medicare would be competing in the private insurance pool, and seniors would have to pick a plan from it. If their plan is more expensive than the two cheapest plans in their area, even if they choose traditional Medicare, seniors have to make up the difference. Adding to the potential confusion, the cheapest could change every year, meaning seniors would have to find new doctors each year, with all the attendant paperwork hassles that involves. So, if your plan becomes more expensive you may choose paying more over dealing with the switch, especially if you have a chronic condition and are afraid you will need to see the doctor during the transition period.