Democrats campaigned on income inequality in 2014, to little success. As President Obama prepares for the State of the Union this week — and Democrats gear up for 2016 — he’s trying to shift the party’s economic message to a new target: wealth inequality.

%22The%20top%201%25%20by%20net%20worth%20own%2042%25%20of%20the%20country%E2%80%99s%20wealth.%22′

Democrats have offered one proposal after another to tax the wealthy to benefit ordinary Americans. But Obama’s new tax plan takes a more targeted approach: He wants to raise taxes on the richest Americans’ inherited wealth, not income, to help the middle-class build their own wealth.

Obama’s plan, unveiled on Saturday night, would eliminate a loophole that allows wealthy Americans to pass on tax-free assets to their heirs. He would raise the capital gains tax for those with incomes above $500,000 from 23.8% to 28% and eliminate a loophole used by a handful of wealthy individuals — including Mitt Romney — to turn tax-preferred retirement plans into tax shelters.

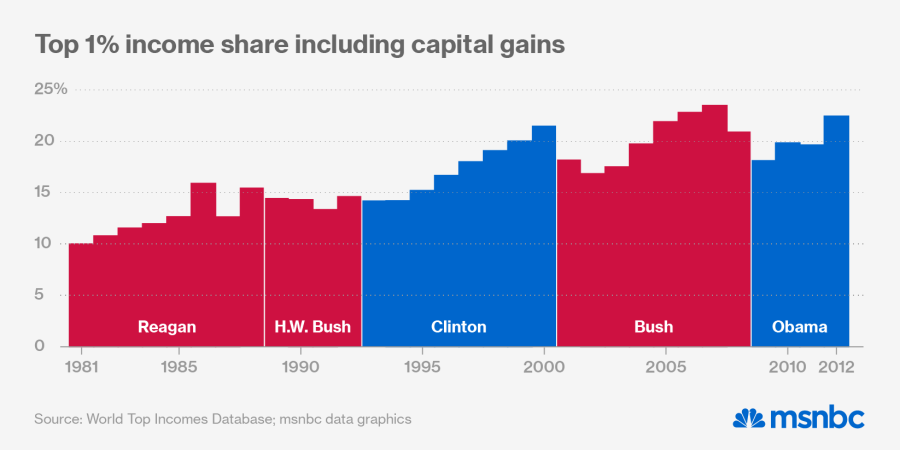

The proposal is specifically targeted at the wealth gap, which is actually far greater than the income gap. While income is what you make, wealth is your net worth — including financial holdings, real estate, and so forth. And because it compounds over time, wealth is even more heavily concentrated in the hands of the few than income: Over the last 30 years, top 1% by earnings received one-fifth of all income; by comparison, the top 1% by net worth owned one-third of the country’s wealth — and in recent years, it’s risen to 42%. That’s because wealth compounds itself over time and is taxed at lower rates than income for rich Americans. And it’s also because many ordinary Americans don’t save enough, and barely half are invested at all in the stock market. (The wealthiest 5% of Americans own more than two-thirds of stocks.)

Related: The state of America’s unequal economy

Obama’s plan aims to shift that wealth imbalance. Combined with a new tax on big Wall Street banks, the higher taxes on the wealthy would be used to increase the wealth and incomes of middle- and lower-income families. The plan would automatically set up retirement plans for employees who don’t have a workplace retirement plan and give businesses who auto-enroll their employees a new tax credit. The goal is to help more Americans build long-term wealth and benefit from the market gains that have disproportionately boosted the fortunes of the richest Americans.

It would also expand tax benefits for working parents and those with children by offering a new credit for second earners for households making up to $210,000, expand the child-care tax credit for families earning up to $120,000, and expand tax breaks for college costs. The plan would also cover the cost of the free community college program that Obama unveiled earlier this month and an expansion of the Earned Income Tax Credit for the working poor that some leading Republicans have joined Democrats in supporting.