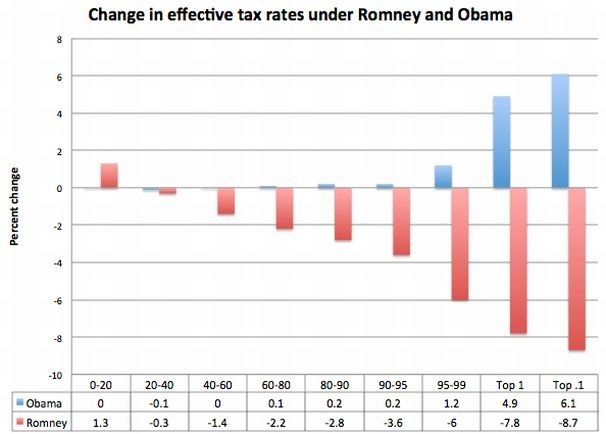

We put Mitt Romney’s tax plan side by side with President Obama’s in a “Go Figure” segment last weekend, but the Republican candidate unveiled a new set of tax cuts recently. The Tax Policy Center just finished its analysis of the new Romney plan, and the good folks at Wonkblog put a graph on it:

Based on the details Romney has provided so far, his plan would lower tax rates for the top quintile by 5.4 percent, saving the wealthiest an average of $16,134. (The top 1 percent of earners, meanwhile, would save an average of $149,997.) The lowest fifth of earners, by contrast, would see a small tax increase of 1.3 percent under Romney’s plan, owing the federal government an additional $143 extra on average.

Obama’s tax proposal, meanwhile, would keep tax rates roughly the same except for married couples making over $250,000 per year (or single earners making more than $200,000 per year). On average, under Obama’s plan, the top 1 percent would be paying about $87,173 more per year.

Wonkblog notes that the Romney’s proposal is incomplete, because Romney “wants to scrap various deductions in the tax code, particularly for high earners, in order to broaden the tax base,” but hasn’t provided any details on how to do so. We’ll wait on those numbers; perhaps in them lies the answer to why Romney thinks making the Bush tax cuts permanent and giving the wealthiest Americans (like him) the biggest tax cut of all would help anyone other than the wealthiest Americans (like him).

And it’s hardly just Romney proposing a tax plan that would be hazardous to the nation’s fiscal health. Rick Santorum’s tax-slashing plan, according, again, to the Tax Policy Center, would be disastrous for federal revenue. Oh, and it could “discourage marriage,” a curious side effect for a Santorum plan of any kind: