We talked earlier about a new report from the nonpartisan Tax Policy Center, which scrutinized the tax plan in the House Republican budget, crafted by Paul Ryan (R-Wis.), and endorsed by Mitt Romney. This afternoon, the specific analysis (pdf) was released, which allows us to dig a little deeper.

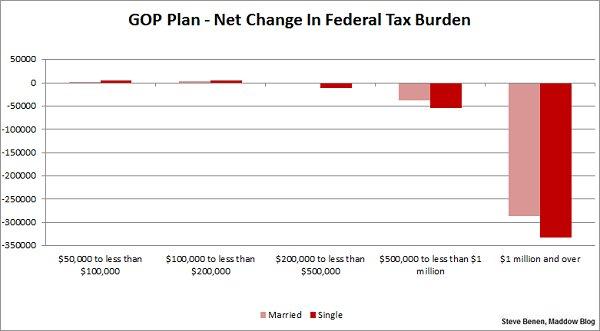

Here, for example, is a chart I put together showing the net change in federal tax burdens by income group. The darker red shows the change for single workers; the lighter red shows the change for married couples filing jointly.

In case this isn’t obvious, the middle class would pay a little more every year, while the very wealthy would benefit enormously. In other words, if you liked the ineffective, budget-busting Bush/Cheney tax cuts, you’ll love the Paul Ryan plan endorsed by Romney.

The main difference: under the Ryan/Romney model, millions of middle-class workers will actually end up paying more in taxes.