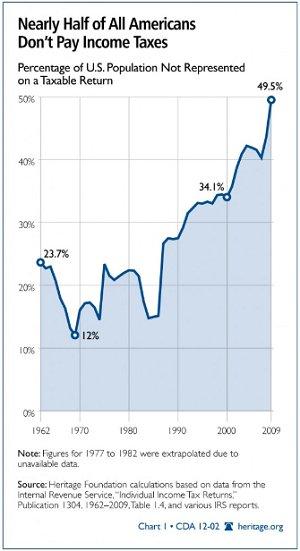

A few months ago, Richard Mourdock, the Republican U.S. Senate candidate in Indiana, complained, “You know this past April, when our federal taxes were paid, 47 percent — 47 percent — of all American households paid no income tax.” The far-right candidate equated the 53 percent vs. the 47 percent to the Civil War.

It’s a strikingly familiar complaint. Though Mitt Romney’s bizarre comments at a closed-door fundraiser, in which he chastised the 47 percent as lazy parasites, is obviously something of a scandal today, we know that Rick Perry, Michele Bachmann, Eric Cantor, and others have raised related complaints.

It’s worth pondering the irony of far-right Republican politicians — ostensibly the most anti-tax major political party on the planet — looking at nearly half of the United States and thinking their tax burdens aren’t nearly big enough. But it’s also worth asking a related question: how did we reach the point at which 47 percent of the country has no federal income tax burden at all?

We talked earlier about the folks who fall into this category: seniors who’ve left the workforce, Americans with disabilities who can’t work, students who have not yet entered the workforce, millions of low-income families, and middle-class families who take advantage of tax credits Republicans have traditionally supported. But that last part is of particular interest: GOP policymakers have helped expand the 47 percent on purpose, so there’s no real point to them whining about it now.