For months, the argument within Democratic circles hasn’t been whether to let tax breaks for the wealthy expire, it’s been a debate over where to draw the line at “wealthy.” President Obama’s original position from 2008 was to set the level at $250,000 (the top 2% of income earners), but over the last year or so, some Democrats have pushed to draw the line at $1 million.

Yesterday, Obama stuck to his guns. There was a real possibility that this would cause some intra-party trouble, but soon after the president’s announcement, both Sen. Chuck Schumer (D-N.Y.) and House Minority Leader Nancy Pelosi (D-Calif.) — who had called for the higher $1 million threshold — endorsed the White House position. Not all Dems are on board, but a united party leadership helps Obama with his broader public pitch.

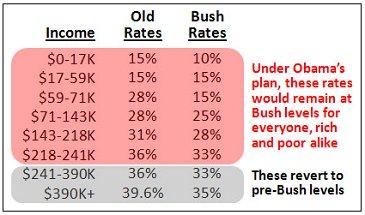

But as the larger discussion moves forward, let’s pause to note a detail that routinely gets lost in the shuffle: thanks to the way marginal tax rates work, even those with incomes above $250,000 would get a tax break. Kevin Drum put together this image yesterday to help drive the point home.

As Dan Amira added, “Obama is not proposing that families making up to $250,000 a year keep their tax cuts while families making more than that don’t. He’s proposing that every family keep their tax cuts on their first $250,000 of taxable income.”