There’s a strange loophole in the federal tax code. Those Americans who become wealthy thanks to private-equity funds — hedge-fund managers, vulture capitalists — get to pay a special, lower tax rate. The result is a tax policy dynamic that’s obviously unfair: some millionaires end up paying a lower rate than most of the middle class.

Democrats have proposed closing the loophole with something called the “Buffett Rule,” which would require those who make $1 million or more to pay at least a 30% rate, and the Senate is scheduled to act on the proposal today. Is there any chance the measure might pass? Well, no — Republicans have vowed to kill the proposal with a filibuster when Democrats try to bring it to the floor this afternoon.

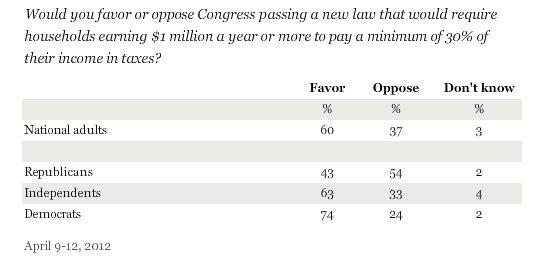

When the Senate minority prevents an up-or-down vote today, they’ll not only ignore the wishes of most members of the Senate, they’ll also ignore the wishes of most of the country — Gallup reported on Friday that Americans favor the Buffett Rule, 60% to 37%.

As for why Republican lawmakers oppose the Buffett Rule, it’s surprisingly tricky to get a coherent explanation out of them. Sen. Scott Brown (R-Mass.), an alleged moderate, explained late last week why he’ll side with the far right against closing the tax loophole.