Republican policymakers already approved a massive package of tax breaks a year and a half ago, and by any fair measure, the GOP tax plan hasn’t worked out as planned.

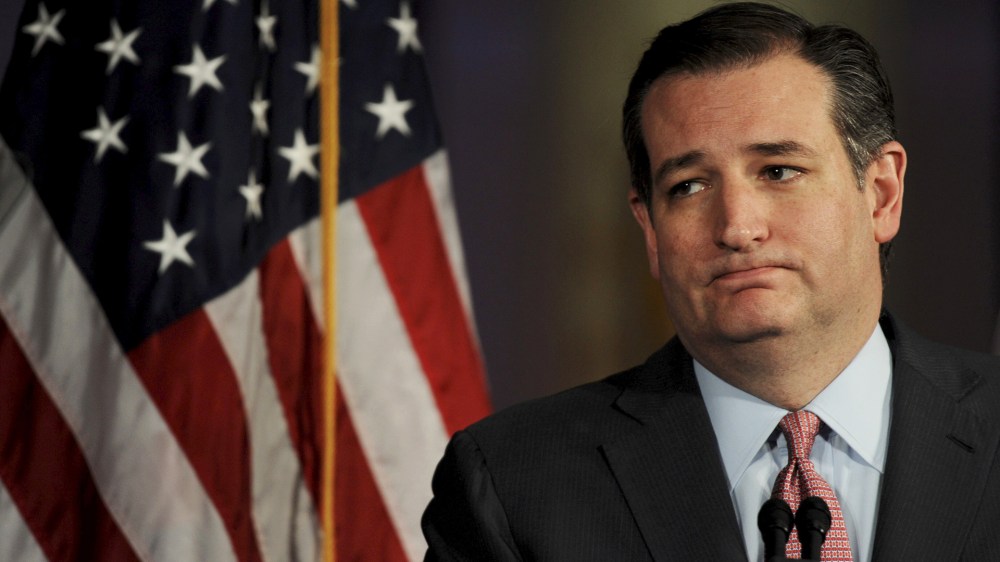

It’s against this backdrop that several Republican senators are demanding another tax cut to benefit the wealthy — though this one would come from the Trump administration, not from Congress. The L.A. Times‘ Michael Hiltzik explained yesterday that 21 GOP senators, led by Sen. Ted Cruz (R-Texas), sent a joint letter to Treasury Secretary Steven Mnuchin “demanding that Mnuchin deliver a new tax cut via executive fiat.”

The GOP complains that the capital gains tax isn’t indexed to inflation. As a result, the argument goes, taxpayers including “everyday Americans” are charged taxes on gains that are due purely to inflation, not to the real appreciation of their stocks or bonds.

“This treatment punishes taxpayers for the mere existence of inflation and is inherently unfair,” the senators write.

The supposed unfairness could be rectified if Mnuchin were to redefine the concept of “cost basis” — that is, the price at which an asset was purchased — to include inflation.

That may sound a little complicated, so let’s unpack this a bit.

The New York Times reported one year ago today that the Trump administration was “considering” a unilateral tax cut, that would almost exclusively benefit the wealthy, by using its regulatory powers “to allow Americans to account for inflation in determining capital gains tax liabilities.”

The article added, “The Treasury Department could change the definition of ‘cost’ for calculating capital gains, allowing taxpayers to adjust the initial value of an asset, such as a home or a share of stock, for inflation when it sells.”

The Washington Post‘s Matt O’Brien recently characterized this as “the most useless and regressive tax cut ever.”

As we discussed a year ago, the question of indexing capital gains taxes to inflation has been around for a while, though the conversation has clearly progressed to new levels of late. Mother Jones’ Kevin Drum summarized the debate nicely:

Let’s say that ten years ago you bought $1,000 in shares of DrumCo stock. Naturally it’s a well-managed company and today those shares are worth $1,300. You sell them for a $300 profit, and pay a nice, low 20 percent capital gains tax of $60.

But then you start to think. What about inflation? That $1,000 in 2008 is the equivalent of $1,150 today. Your real profit is only $150, and $60 represents a capital gains tax of 40 percent. What a rip off! Part of your “profit” is really just keeping up with inflation. Why do you have to pay any taxes on that?

Under current tax law, inflation is irrelevant. Lawmakers have generally concluded that it’s too tricky to change the law, so they’ve instead created a low capital-gains tax rate to make investors happy.