We’ve been hearing endlessly about the fiscal cliff. And yet, when it comes to the impact of going over that cliff, many people appear to have it exactly backwards.

Forty-seven percent of respondents to an online poll conducted by Survey Monkey on behalf of Business Insider wrongly said that going over the cliff would mean the deficit gets larger. Just 12.6 percent accurately said it would mean the deficit shrinks. And 11.9% said it would stay the same.

As Business Insider notes, Survey Monkey has a good track record and was more accurate during the election than many phone-based pollsters.

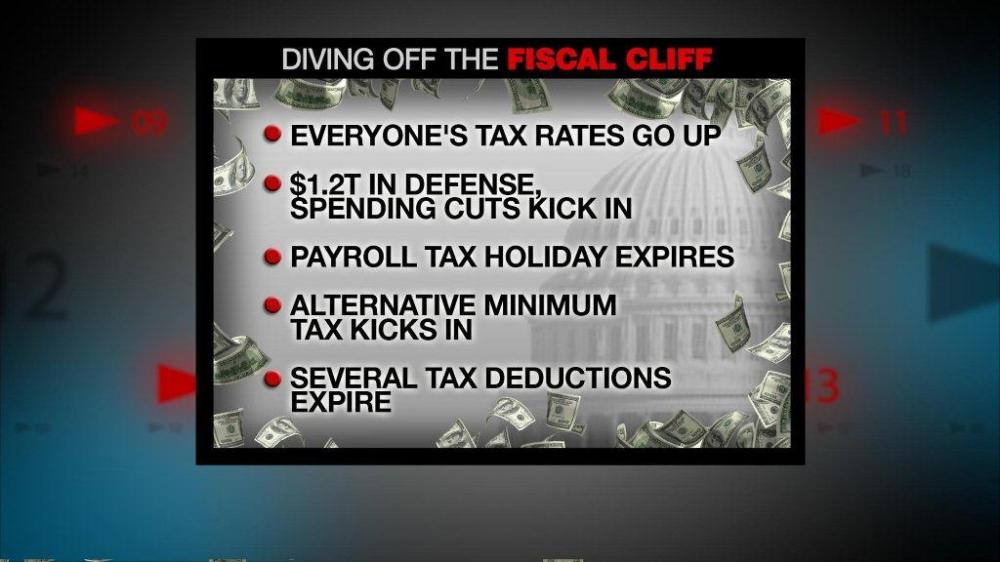

If Congress doesn’t come to a deal to raise taxes and cut spending before it leaves, we’ll go over the cliff on Jan 1st—though it’s really more of a slope. That means a combination of spending cuts and tax hikes worth abut $607 billion will go into effect, thanks to an agreement made last year between Congress and the Obama administration, which prioritized reducing the deficit at all costs.

The problem is that raising taxes and cutting spending, especially doing so suddenly, will depress already-weak economic growth, leading to higher unemployment and perhaps even another recession. The Congressional Budget Office found it’ll cause the economy to contract by about 0.5% in 2013, though some economists say that estimate is too low.