The Affordable Care Act is hitting two major milestones this week and next. March 23 marks four years since the law took effect, and Monday, March 31, marks six months since new marketplaces for health insurance opened in all 50 states. With some exceptions, all Americans are legally required to have health coverage by that date.

What does the Affordable Care Act mean to you? What aspects of it still concern or confuse you? As part of msnbc’s countdown to March 31, national health reporter Geoffrey Cowley fielded questions you posted on msnbc.com and Facebook. Here are his responses, organized around four aspects of Obamacare: the rationale, the provisions, the mandates, and the deadlines.

WHAT’S SO GREAT ABOUT THE AFFORDABLE CARE ACT?

Mr. Picatinny: Geoffrey, have you personally enrolled in Obamacare…I mean, the Affordable Care Act?

No, I’m lucky enough to have an employer who sponsors and subsidizes my health coverage. The Affordable Care Act is designed to help people buying insurance on their own. Until recently, insurance companies screened individual buyers for potential health needs and penalized or excluded anyone who might actually need care. The Affordable Care Act bars that discrimination, and it uses tax credits to subsidize coverage for people with modest incomes.

Thomas W. Sandoz III: I don’t understand what the downsides of Obamacare are. As I understand, it will reduce medical costs and make healthcare more affordable for all. The Republican Party is staking everything on the repeal. What is the benefit to them? What would be the benefit to the public of the repeal? I am not asking this to be partisan. I am asking because I don’t see any downside to a better situation. Please respond in a non-partisan manner to help me understand.

I share your bewilderment. Obamacare is based on Republican ideas that were promoted by the Heritage Foundation and pioneered in Massachusetts under Governor Mitt Romney. The law keeps the for-profit insurance industry at the center of our health care system, and it relies on market competition to control costs. We don’t yet know how well it will work, but no one denies that the old system was unsustainable.

The Right’s main objections center on government outlays (expanding the safety net through Medicaid and tax credits) and government mandates (requiring everyone to have health insurance). Honest people can differ on the merits of those policies. But rather than argue for a credible alternative, Obamacare’s opponents have stayed mainly in attack mode, using fear and confusion to fuel public resistance to the law. I think the resistance will soften as more and more of the nation’s 40 million uninsured people experience affordable health care.

WHO GETS COVERAGE? WHO GETS HELP?

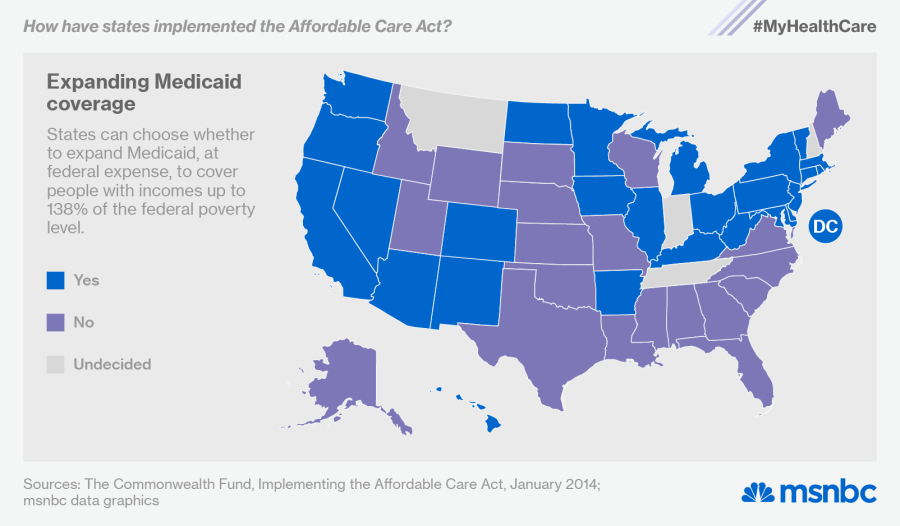

As originally signed into law four years ago, the Affordable Care Act would have created a seamless safety net offering different levels of assistance for people earning up to four times the federal poverty wage ($46,680 for an individual, $95,400 for a family of four). The law expanded Medicaid to provide complete coverage for people earning less than 139% of the poverty wage ($16,105 for an individual, $23,850 for a family of four). And it provided subsidies, in the form of tax credits, to help people earning one to four times the poverty wage buy private coverage through the new health insurance exchanges.

The law actually works that way in the 27 states that have expanded their Medicaid programs at federal expense (here’s a list of the expansion states). But because a 2012 Supreme Court ruling enabled states to opt out of the Medicaid expansion, two dozen of them have done just that—leaving billions of federal dollars on the table and leaving 5 million low-income people completely ineligible for any form of assistance.

Medicaid already covers children living below 200% of the poverty level in most states. It also covers adults who are disabled. But it has traditionally excluded most non-disabled adults, no matter how poor they are and no matter how hard they work. In the non-expansion states, those folks now live in a coverage gap—too rich for traditional Medicaid but too poor for subsidized coverage in the marketplace. Several of the questions in this section come from people in that situation.

Deborah Crane from Facebook: I just got a job. Make $900 a month. What are my options?

Your yearly income ($10,800) falls just below the federal poverty level ($11,670 for an individual). If you live in one of the 26 states expanding Medicaid, you’ll qualify for full coverage. If not, you’ll have to forego health insurance unless you can pay the full cost of a marketplace plan.

Walter Shepherd: My Daughter Works at a Hardee’s in western North Carolina. She has two kids and earns $7.50 an hour. Hardees will not allow her over 26 hours per week. They say they cannot give her 40 hours due to the Affordable Care Act. Not only can she not afford insurance but she may be fined for getting only 26 hours a week. How is that justifiable?

If your daughter is the sole breadwinner in a three-person household, her kids will easily qualify for Medicaid. But a parent must live below 46% of the poverty level (roughly $9,000 a year for a family of three) to get Medicaid coverage in North Carolina. Your daughter’s annual income ($10,140) will disqualify her. And because she lives below the federal poverty level ($19,790 for a family of three), she won’t qualify for assistance in the marketplace either.

North Carolina lawmakers could help her by expanding its Medicaid program at federal expense. Congress could help her by extending marketplace subsidies to low-income people. And her employer could help her by sponsoring her health coverage. Starting in 2016, the Affordable Care Act will require large companies to sponsor health insurance for all their full-time workers. Hers apparently hopes to minimize that obligation.

Deb Smith: I was told that I make too little income to qualify for financial assistance in the health insurance marketplace. I live on Social Security, which amounts to about $12,000 for the year. I was referred to Medicaid in my state of North Carolina, but I was ineligible because the state hasn’t expanded its Medicaid program. I received a letter from the government saying I would not be fined for not having insurance. However no one is telling me of any option for me to obtain affordable insurance. Do you know of any alternative for me? Thank you.

If you live alone, you should qualify financial assistance in the marketplace, because your annual income ($12,000) falls between 100% and 400% of the federal poverty level ($11,670 to $46,680 for an individual). Here’s a simple chart you can use to check your eligibility, and here’s an interactive subsidy calculator.

If your income falls below $11,670, landing you in the coverage gap, you’ll get a hardship exemption from the federal mandate to purchase insurance. As the government explained in the letter you received, there’s no penalty for going without insurance if “you were determined ineligible for Medicaid because your state didn’t expand eligibility for Medicaid under the Affordable Care Act.”

missourirobert: Is it true that because the Republicans in the Missouri State Legislature and State Senate have blocked the expansion of Medicaid, lower-income Missourians will not be eligible for federal tax credits to help pay the Obamacare premiums?

No, that’s not true. The marketplace subsidies are available in all states, even those that aren’t expanding Medicaid.

John-2828835: I am 62, and so far in pretty good shape. I have not been insured for years, but I support the ACA and would sign up if I could. My problem is, where, and how portable is it? I ask because I spent 2012 in China and right now I live in Panama. I will be coming back to the States in a few months but have not settled yet on where. I prefer the weather in the south, but the south generally has no ACA. How much does that matter, where I live and where I’ve signed up?

As a U.S. citizen living outside the country, you’re exempt from the health-insurance mandate. When you move back to the states, you’ll have to secure coverage within 60 days to avoid a tax penalty.

If you plan to buy coverage through the marketplace, you don’t need to worry about settling in the South. Many southern states are refusing to expand Medicaid, but every state has a health insurance exchange. And though insurance prices vary by region, federal financial assistance is available in every state.

Sarah Jorgensen from Facebook: Can you use your Obamacare coverage across state lines?

In an emergency, yes. If you buy a marketplace health plan in New York and get hit by a car in Florida, your insurer can’t penalize you for going to a hospital outside of its network. But for non-emergencies, you’ll want to stick with your plan’s provider network. If you buy your insurance in New York but spend half the year in Florida, you should shop for a plan whose network includes some Florida doctors and hospitals.

Tony Adams from Facebook: I am a veteran with only a 60% disability rating, which does not cover vision or dental at all. Also, I never get to see a doctor as often as I need to. So the real question is: can I supplement with ACA without ruining my VA health care? I’m almost afraid to go online and ask!

Don’t worry, Tony. You can supplement your VA health coverage without risking a penalty. VA health care qualifies as minimum essential coverage, so you’re not required to supplement it (and you won’t qualify for subsidies if you do). But the extra coverage won’t interfere with your VA benefits. As the VA explains in this online fact sheet, “You can continue to use VA for all your health care needs, or complement your VA care with private health insurance or with coverage by other federal health care programs, including Medicare, Medicaid, and TRICARE.” If you need more information, the VA has a helpline: 877-222-8387.

DR.DOORJAMMER: My wife and I are disabled—she 3 years, me 1-and-a-half. Why does the government think we are wealthy? We live on disability and can’t afford insurance at $500 a month for me. I can’t get Medicare till 2015, and if I don’t get insurance soon I will die from stage 3 kidney disease and heart disease. Why does the government think I am wealthy, and why does it want me dead? Explain this.

The government declined to explain why it wants you dead, but you may be able to foil the plot by signing up for Medicaid. In most states, a person receiving federal disability payments qualifies automatically for Medicaid. Some states require a separate Medicaid application, but you should have no trouble qualifying in any state. Here’s some additional background on Medicaid for people with disabilities.

G. Bud: When determining what counts for eligible income, where would these sources fall? First, SSI disability insurance payments. Second, long-term disability payments from a private insurer if you paid a premium for this during past employment.

Any income that is taxable will count when you apply for financial assistance. SSI (Supplemental Security Income) is not taxable, so it won’t affect your eligibility. Some long-term disability benefits are taxable and some are not. As Ameriprise Financial explains in this fact sheet, it depends on (a) what type of benefits you receive, (b) whether the premiums were paid with pretax or after-tax dollars, and (c) who paid the premiums (you or your employer).