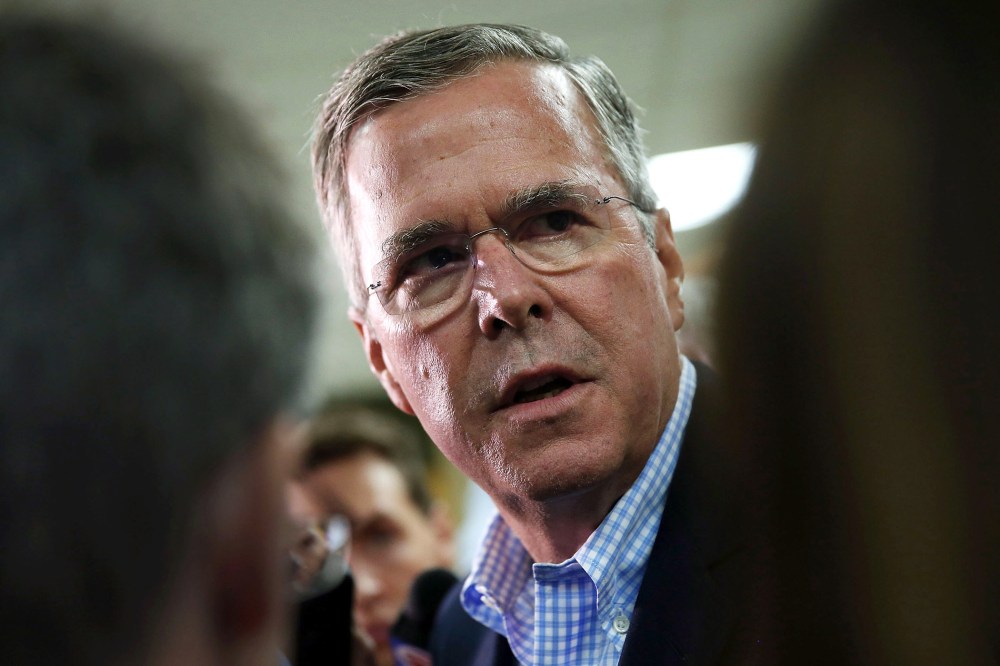

On Wednesday, former Florida Gov. Jeb Bush unveiled his tax plan, which he promises will raise real economic growth to 4%, something that hasn’t been achieved since Bill Clinton’s administration and no reputable economist thinks is realistic under current circumstances. Although Bush claims that his policies are consistent with those of Ronald Reagan, the similarity is more superficial than real.

%22There%20is%20no%20doubt%20that%20Bush%E2%80%99s%20tax%20plan%20would%20blow%20a%20massive%20hole%20in%20the%20budget%20deficit.%22′

The Bush tax plan would lower the top federal income tax rate to 28% from 39.6%. As he correctly notes, this was the top rate in effect after enactment of the Tax Reform Act of 1986. However, there is no evidence that the economy grew faster between 1987 and 1993, when the top rate was raised by Bill Clinton. There is, however, considerable evidence that growth increased after taxes were raised in 1993, the exact opposite of what Republicans claimed would happen.

Bush does not come close to paying for his rate cuts, which include a reduction in the corporate tax rate to 20% from 35% — well below what most individual taxpayers would pay under his plan. Reagan was quite insistent that the Tax Reform Act of 1986 be revenue-neutral by closing tax loopholes.

Bush’s plan would partially broaden the tax base by abolishing the deduction for state and local taxes, which would sharply raise the burden of such taxes. He would cap all other itemized deductions except that for charity. This means limiting the deduction for mortgage interest, which will undoubtedly reduce the price of many homes.

RELATED: The roots of Jeb Bush’s tax plan

There is no doubt that Bush’s tax plan would blow a massive hole in the budget deficit. His own economic advisers estimate that it would raise the budget deficit by $3.4 trillion over 10 years. Even if their dubious estimate of higher growth is achieved, massive spending cuts will be needed just to keep the deficit from rising above current projections.

In this respect, Bush’s tax plan is much more similar to his brother’s than to Reagan’s tax reform. According to the Congressional Budget Office, George W. Bush’s tax cuts added $3 trillion to the national debt and did nothing to raise growth or forestall the massive recession that began in 2007. That recession was still ongoing when Barack Obama took office, yet Jeb spends much space in his proposal criticizing him for not immediately reversing all the negative budgetary effects of his brother’s policies, which added a total of $12 trillion to the national debt, according to CBO.

%22We%20had%20a%20real%20world%20test%20of%20Jeb%20Bush%E2%80%99s%20tax%20plan%20from%202001%20to%202008%20–%20and%20it%20failed%20miserably.%22′

It appears that Bush has relied upon advice from economists who have been wrong about just about everything to do with taxes for the last 20 or more years. One, Stephen Moore, who founded the Club for Growth and now works for the ultra-right-wing Heritage Foundation, published a book in 2004, “Bullish on Bush,” that made the same extravagant promises for George W. Bush’s tax cuts that Jeb Bush now claims for his.

The reality is that the U.S. economy did very, very poorly under George W. Bush — even before the recession began in December 2007. At the very minimum, there is zero evidence that his tax cuts did anything whatsoever to raise growth or lower unemployment. What little improvement there was resulted from Federal Reserve policy and the normal workings of the business cycle.