Too much debt is too much debt–no matter who is charging the country’s credit card, said Douglas Holtz-Eakin on Morning Joe.

Holtz-Eakin is the former director of the Congressional Budget Office and former chief economic adviser to Sen. John McCain’s presidential campaign and presently serves as the head of American Action Forum. He argued on Wednesday that history proves that too high debt makes for too low growth, regardless of what the debt was used to fund.

“All you’ve got to do is look at the historical record and countries get too much debt grow slower than countries who look the same, and have the same approach to economic policy, but have less debt,” Holtz-Eakin said.

NOW host Alex Wagner pointed to Holtz-Eakin’s own party, asking “where was this rhetoric when we were getting involved with two wars and paying for them on a credit card and also having major tax cuts put in place? The Iraq war was the first war where we haven’t had a war tax–where was this fiscal responsibility a decade ago?”

“Missing,” Holtz-Eakin responded. “I said famously in budget circles–you know, a big crowd–I said in 2003 that the party’s over, people get it, we’re not going to spend any more money and 10 years later, I was dead wrong…We lost our rudder somewhere.”

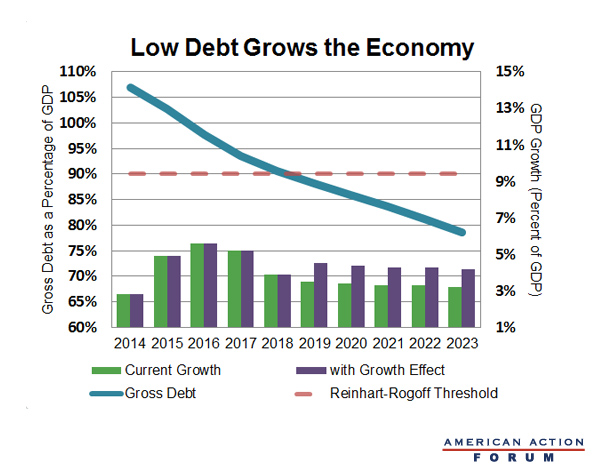

Holtz-Eakin pointed to a detailed study by the AAF that found, after studying 44 different countries over the last two centuries, that when gross debt rises above 90% of GDP (a tipping point identified by economists Carmen Reinhart and Kenneth Rogoff), growth slows. Current policy keeps gross debt above 90% till 2023, which Holtz-Eakin said will slow economic growth year after year.

Reducing the debt, however, would do the opposite, according to Holtz-Eakin: