As states start to reopen their economies, many of us will be reopening our wallets as well.

If you’ve been staying home, you likely haven’t been spending as much as you normally would. According to the Bureau of Economic Analysis, personal consumer expenditures decreased by 13.2 percent from March to April. And personal savings rates are at an all-time high of 33 percent, up over 25 percentage points since January.

But now that the economy is beginning to re-open, there is a risk of overspending.

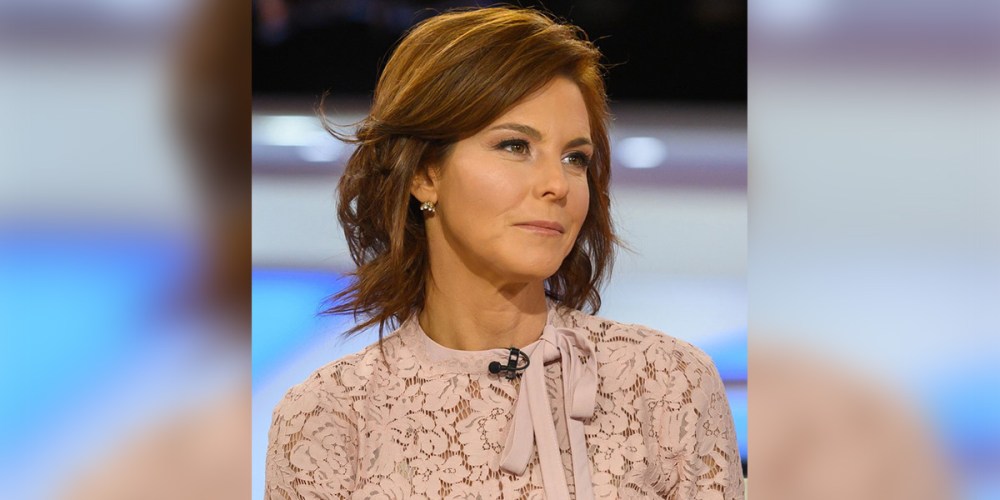

Budgeting can be a little like dieting, said MSNBC anchor and NBC News senior business correspondent Stephanie Ruhle. If you suddenly stop your healthy eating plan, you might be tempted to eat an entire box of cookies in one sitting because you can. “If you start swiping your credit card, you might have a hard time knowing when to stop,” said Ruhle. Here are five ways to help keep your spending under control.

1. Make a plan.

First and foremost, make a plan. Your budget likely changed at some point during the pandemic. Take another look at it now that you can spend a little more freely. Budgets are living documents and need to be updated to suit your needs in the moment. Having the mental framework is helpful, even if you need to change it again. “It’s key to make a roadmap,” said Ruhle.

2. Consider the “why” behind your spending.

Think about how you want to spend your dollars now that states are starting to reopen, suggested Ruhle. Aligning your spending with your priorities can help in making mindful purchases. If supporting local business is important to you, maybe that means ordering dinner to go from a local restaurant, but only once or twice a week. If you want to feel less restricted in your spending, consider setting a dollar limit on impulse buys at the store. Whatever will work for you, make a list, and keep that in mind before you hand over your card.