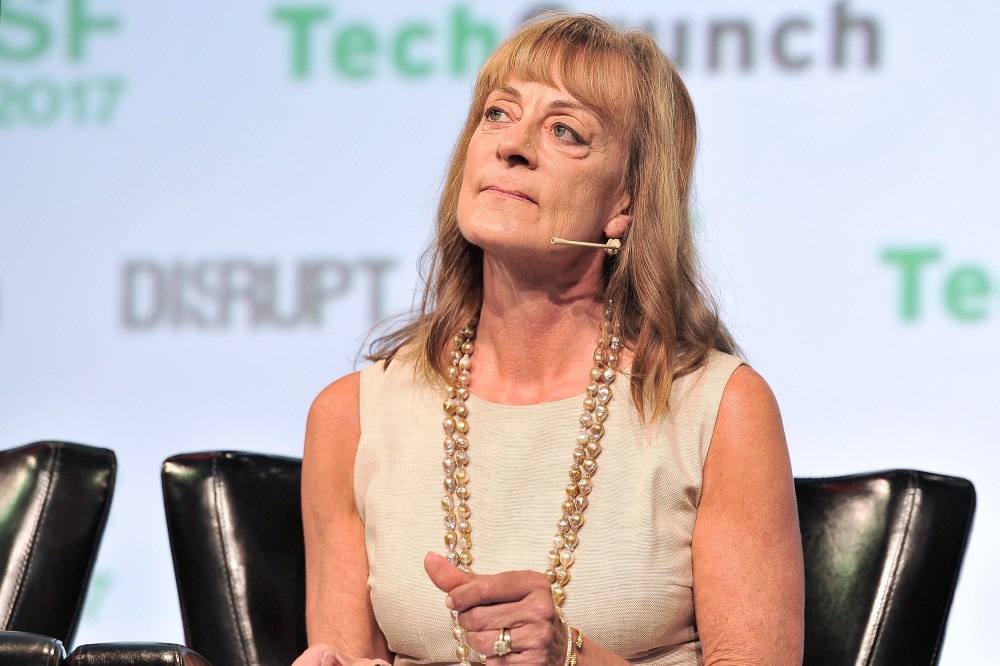

Venture capitalist Nancy Pfund has long been a respected business leader in the San Francisco Bay Area, placing early and successful bets on climate tech startups including Tesla, Nextracker, SolarCity and The RealReal.

But she never imagined her career path – which originally began in environmental regulation – would take the entrepreneurial turn it did back in the early 2000s. For two decades she worked at investment bank Hambrecht & Quist, which was sold and became part of JPMorgan in 1999. Then in 2003 – at the age of 50 – she started an in-house impact investing strategy at JPMorgan.

By 2008, she’d spun that impact fund into its own independently-managed venture firm called DBL Partners, which stands for Double Bottom Line. Launched with the goal of funding profitable and environmentally-minded investments, her VC firm more recently closed its 4th fund – a $600 million climate tech–focused initiative – aimed at preventing wildfires.

Pfund’s pioneering investments to spur social change and environmental improvement recently landed her on Forbes and Know Your Value’s third annual “50 Over 50” U.S. list, which came out on Aug. 1. The list spotlights dynamic women over the age of 50 who have achieved significant success later in life, often by overcoming formidable odds or barriers.

“Impact has always been part of who I am,” Pfund told Forbes and Know Your Value. “But it was expressed at varying levels throughout my various jobs and never fully evolved until starting the first impact fund.”

When Pfund started at Hambrecht & Quist, she was a securities analyst, reporting on instrumentation stocks and analyzing Superfund sites. Later she switched to venture capital at the firm and took on the company’s public affairs, political work and philanthropic giving responsibilities.

“And then finally right after the dotcom boom – and bust – we raised our first fund that combined those jobs into one,” she added. “That’s what became DBL Partners.”

For years, Pfund pushed the notion that DBL’s venture capital model – coupling return on investment with a social agenda – was not mutually exclusive, or concessionary. As the fund’s investments in the burgeoning solar industry turned profitable, she made the risky move to become one of the first institutional investors in Tesla.

“There was not a lot of warm and fuzzy support for that investment, and no one had ever done it before in this region,” she said. “And so it was not popular, and it was very hard to raise money for Tesla in those early days … [but today] Tesla is an icon [and] it’s really showing us how to get to a sustainable future.”

Today Tesla is the industry leader in electric vehicles, soaring past other automakers like Ford and GM in the category, and projecting production of 20 million electric vehicles per year by 2030.