When Republicans created the United States’ first-ever debt-ceiling crisis a decade ago, the GOP’s principal opponents were not simply Democrats in the White House and Congress. Private sector leaders were also not pleased with the Republican Party’s threat to crash the global economy on purpose.

For months, the business community simply assumed that the GOP was engaged in a meaningless stunt. But as the threat of default intensified, prominent organizations that have traditionally aligned with Republicans — the U.S. Chamber of Commerce, the National Association of Manufacturers, et al. — told GOP leaders they needed to stop screwing around.

Republicans were certainly aware of the concerns. In April 2011, Politico reported that then-House Speaker John Boehner had spoken directly with top Wall Street executives, asking how long he and his party could play with fire before it started doing real economic harm.

The GOP pressed on anyway, inviting an economic calamity, and ignoring the pleas of their own country’s private sector. The United States narrowly avoided default, but not before the Republicans’ antics undermined the nascent economic recovery and forced the first debt downgrade in American history.

A decade later, most observers seem to assume that the GOP won’t actually impose a deliberate recession on the United States, but we’re all running out of time as the debt-ceiling deadline approaches. Not surprisingly, history is repeating itself, with powerful private-sector players making their voices heard. The Washington Post reported this morning:

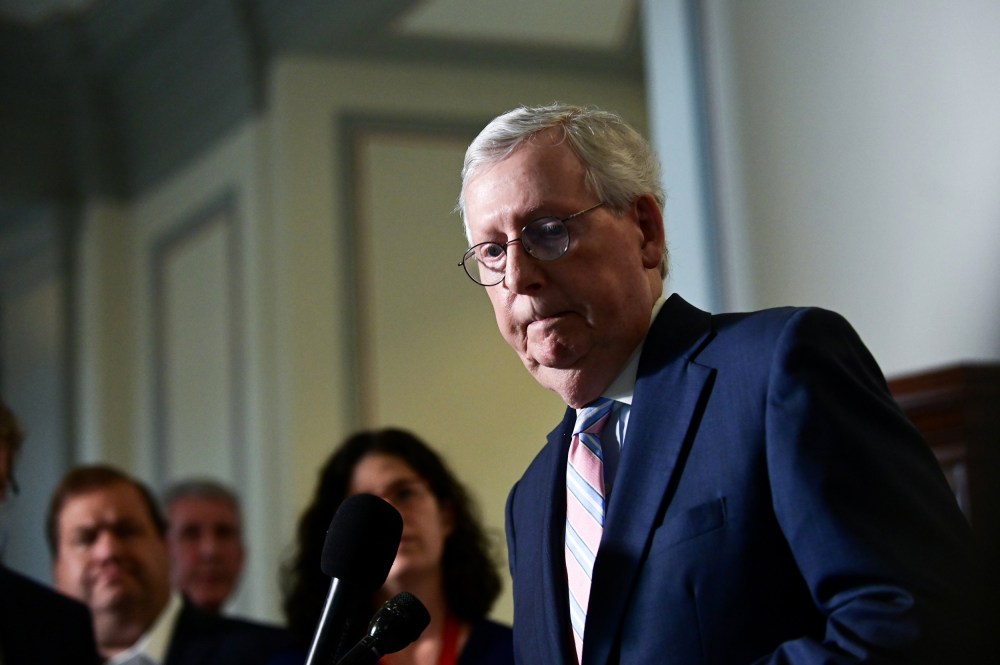

Two former GOP treasury secretaries held private discussions this month with Treasury Secretary Janet Yellen and Senate Minority Leader Mitch McConnell (R-Ky.) hoping to resolve an impasse over the debt limit that now threatens the global economy, according to four people aware of the conversations. The previously unreported talks involving the GOP economic grandees — Henry Paulson, who served as treasury secretary under President Bush; and Steven Mnuchin, treasury secretary under President Trump — did not resolve the matter and the U.S. is now racing toward a massive fiscal cliff with no clear resolution at hand.

In case this isn’t obvious, Paulson and Mnuchin are not just former cabinet members from Republican administrations. Paulson was the CEO of Goldman Sachs and currently leads a multi-billion-dollar investment fund. Mnuchin was also an executive at Goldman Sachs, before taking leading roles at several hedge funds. Just this week, Bloomberg News reported that Mnuchin is taking the lead with a new multibillion-dollar private equity fund.

In other words, guys like these have an added incentive to steer Republicans away from efforts to crash the economy on purpose: Paulson and Mnuchin aren’t just former officials who led the Treasury Department, they’re also financiers whose investments might be destroyed by their own party.