Yesterday, reporters asked Senate Majority Leader Mitch McConnell (R-Ky.) whether he’s comfortable with Donald Trump’s choices for the Federal Reserve’s Board of Governors. The GOP leader raised a few eyebrows by dodging the question.

McConnell’s reluctance to answer was emblematic of a broader concern within his conference. The Wall Street Journal reported overnight:

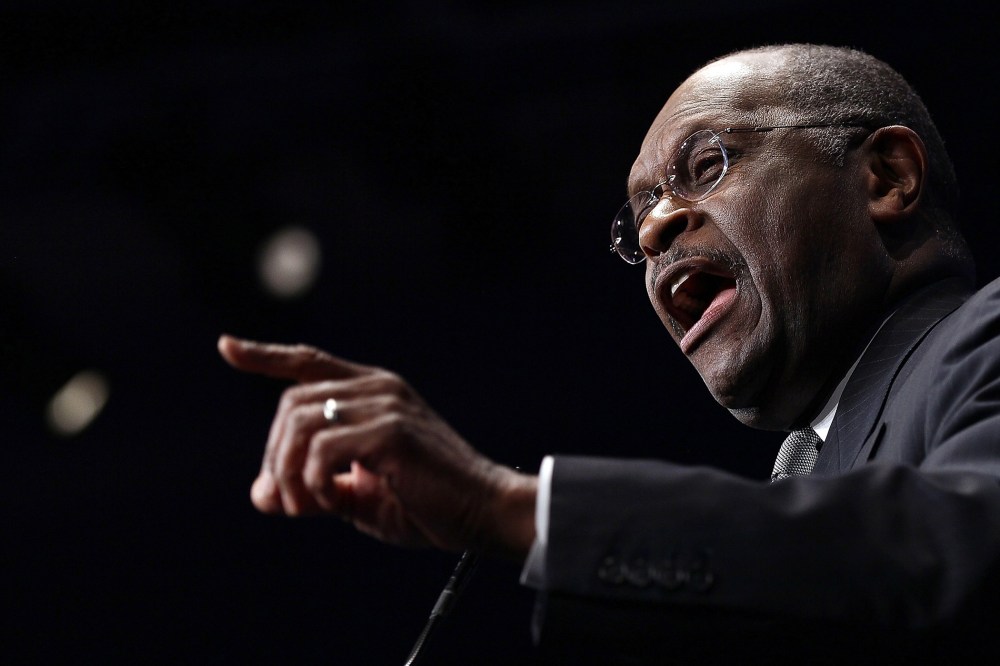

Senate Republicans sounded increasingly doubtful Tuesday about the prospects of confirming President Trump’s latest pick for the Federal Reserve Board, former GOP presidential candidate Herman Cain, who has dismissed criticism of his candidacy as partisan.

“It’s hard for me to imagine he’d be confirmed,” said Sen. Kevin Cramer (R., N.D.), a member of the Banking Committee and one of the president’s strongest allies on Capitol Hill.

Politico added, “Republican senators have generally waved through Trump’s nominees over the past two years, but they are reluctant to do the same for the Fed, amid fears that Trump’s push to install interest-rate slashing allies will politicize the central bank.”

At a certain level, all of this is refreshingly reassuring. By any sane measure, elevating Herman Cain to the Fed’s board of governors is plainly absurd. Even the most cursory review of the Georgia Republican’s background makes clear that the very idea is indefensible, and the fact that Senate Republicans are balking suggests, even in 2019, there are still some limits in GOP politics.

But the good news comes with some fine print. Politico‘s report added, “Some GOP senators said that Cain’s difficult path might have eased Stephen Moore’s confirmation to the Fed, despite Moore’s own problems with unpaid taxes and his partisan reputation. After all, Republicans might be hard-pressed to revolt against both of Trump’s nominees.”

You have got to be kidding me.

Look, Cain appears to be a bridge too far for Republicans. I’m glad. But if the ludicrousness of a Cain nomination helps make Stephen Moore appear more qualified by comparison, that’s still a significant problem — because Moore is a ridiculous choice for the Fed board, too.

Jon Chait pointed to a new detail yesterday that I hadn’t heard before.

A little over two and a half years ago, Stephen Moore appeared at a conservative panel on the election and the economy, where one questioner asked about monetary policy. “Well, you know, I’m not an expert on monetary policy,” admitted Moore, before proceeding to deliver an answer bearing out this very confession. (The question concerned “cash flow velocity,” which Moore deflected by ignoring, retreating to a generality — “We want clear rules and a stable dollar” — and then changing the subject to regulation.)

Moore could casually admit his non-expertise in the subject because, at that moment, it was impossible for anybody in the room, least of all Moore, to imagine that one day he might be nominated for a position on the Federal Reserve Board. The old “what is your greatest weakness?” interview question is one you’re supposed to answer by noting some peripheral trait or skill. You can say “monetary policy” — I’m no monetary policy expert, either — as long as the job you’re gunning for is not in central banking.

Yet here we are.

In any sensible environment, this would effectively end the conversation. The Fed’s Board of Governors is responsible for dealing with monetary policy. Moore has already admitted that he knows very little about how the Federal Reserve works and is equally unfamiliar with monetary policy.