Sometimes, a simple, eight-word headline can say quite a bit: “Fed Chief Calls Congress Biggest Obstacle to Growth.”

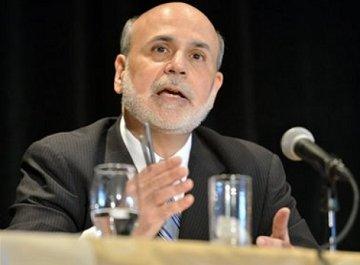

The Federal Reserve’s chairman, Ben S. Bernanke, said Wednesday that Congress is the largest obstacle to faster economic growth, and he warned that upcoming decisions about fiscal policy could once again undermine the nation’s recovery.

“The economic recovery has continued at a moderate pace in recent quarters despite the strong headwinds created by federal fiscal policy,” Mr. Bernanke said in the opening line of his prepared remarks to a Congressional committee.

Moreover, he said, Congress could make things worse later this year. “The risks remain that tight federal fiscal policy will restrain economic growth over the next few quarters by more than we currently expect, or that the debate concerning other fiscal policy issues, such as the status of the debt ceiling, will evolve in a way that could hamper the recovery,” he said.

I’ll confess I’ve been obsessed with this issue for quite a while, but I continue to believe it’s important.

For a variety of reasons, Fed chairs tend to be hyper-cautious when speaking about the state of the economy in public, and they avoid assigning blame unless the evidence is painfully obvious. Bernanke, a conservative Republican originally appointed to his position by the Bush/Cheney administration, has a deserved reputation for being judicious and circumspect.

But when Bernanke talks to Congress, he’s less cautious and more direct. “The economic recovery has continued at a moderate pace in recent quarters despite the strong headwinds created by federal fiscal policy” is an exceedingly polite way for the Fed chair to say, “The economic recovery would be more robust if you clowns stopped cutting spending so much. Oh, and if Republicans screw around wit the debt ceiling again, too, you’ll make things even worse.”