The original debt-reduction plan proposed by former Sen. Alan Simpson (R-Wyo.) and Erskine Bowles (D-N.C.) generally won plaudits from pundits, which always struck me as a shame. It was, to be sure, well to the left of anything Republicans would even consider, but it was also well to the right of what seems desirable, especially on Social Security.

Indeed, the Simpson-Bowles plan generally seemed more focused on reducing the size of government for the sake of an ideological agenda than reducing the long-term debt to meet any specific fiscal need.

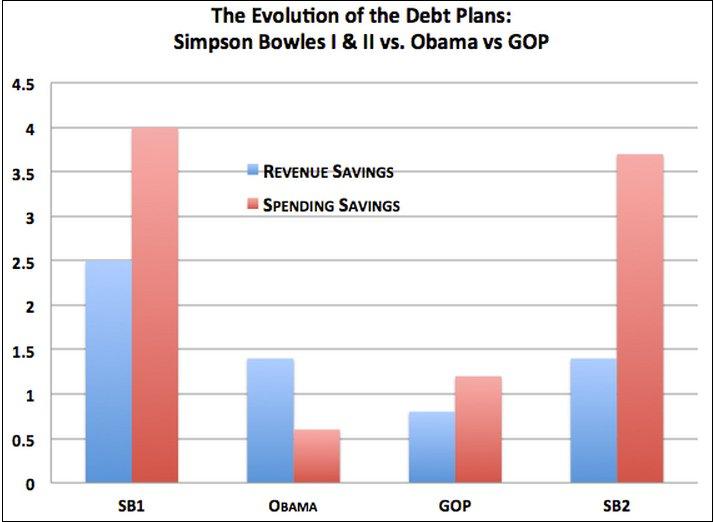

Regardless, Republicans on the Simpson-Bowles commission refused to compromise and the chairmen’s report was never seriously pursued. Two years later, however, Simpson and Bowles have unveiled a sequel, which, like the original, intends to reduce the debt by about $5 trillion over the next 10 years. So it’s more of the same? Not exactly — take a look at this chart from Derek Thompson.

The original Simpson-Bowles plan aimed for some semblance of balance, though spending cuts topped revenue. The new Simpson-Bowles plan, however, is entirely one-sided, leaning heavily in Republicans’ favor.

I’d like to go into more detail as to how and why these proponents crafted their plan this way, but in an odd twist, Simpson and Bowles published their new plan with hardly any numbers in it. In fact, it’s probably a mistake to call this an actual “plan,” when it’s more of an outline. I know roughly how much they want to cut, but as is the case with Republican rhetoric in general, I don’t know where the cuts would occur or by how much.

There have been plenty of debt-reduction packages put together over the last couple of years, but the new Simpson-Bowles proposal is the vaguest. It’s not encouraging.