RIDGELY, Md. — The house is full of everything the Moody family wants to leave behind when their foreclosure nightmare—five years and counting—finally comes to a close.

There are the piles of clothes that Paul and Kim’s four daughters have outgrown since their mortgage troubles began in 2009. The door where the sale notice was posted, forcing them to rush to court to stop the auction. The exposed insulation in the room they stopped remodeling when they realized how long they would be in financial limbo.

“I need to move on,” says Paul Moody, 46, a land surveyor who lives in a rural stretch of Maryland’s Eastern Shore. “It’s destroyed our credit. It’s destroyed our quality of life.”

From Wall Street to Washington, the revival of the U.S. housing market has produced a huge sigh of relief as home prices and construction have rebounded. But for homeowners like the Moodys, the great foreclosure crisis has never ended.

The Moodys missed a single mortgage payment in February 2009 after Paul injured his back, lost his job, and drew down his bank account faster than expected. Five years later, after wrangling with three different mortgage servicers, two foreclosure attempts, and more than a dozen different applications for loan modifications, the Moodys still haven’t come to a resolution.

“You keep getting notices. Then we fight. Then we stay another 45 days,” says Kim Moody, 38, a letter carrier for the Postal Service. “It’s been like that for five years.”

Kim is now in the process of relocating to Franklin, Tennessee, where she accepted a transfer for a better job with a regular route and hours. But her husband can’t move with the rest of the family until the mortgage mess is resolved for the cream-colored ranch house they bought for nearly $300,000 in 2004.

“My hands are tied,” Paul says, sitting in the unfinished family room as his four-year-old daughter climbed onto his lap. “They wear you down, you just give up and surrender. Then they have the house. And then they flip the house.”

***

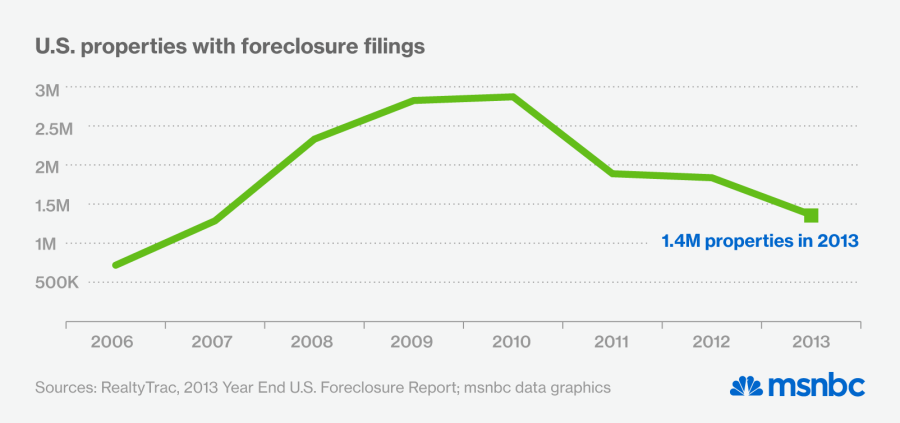

The Moodys are just one of countless families who are still dealing with the aftermath of the Great Recession’s housing meltdown. The worst of the foreclosure crisis passed years ago, but it has continued to cast a shadow over homeowners in places like Maryland, where many old cases are still winding through the system. Despite promises for strengthened oversight from officials in Washington—and everywhere else—abusive practices have continued to ensnare underwater homeowners and prolong the pain.

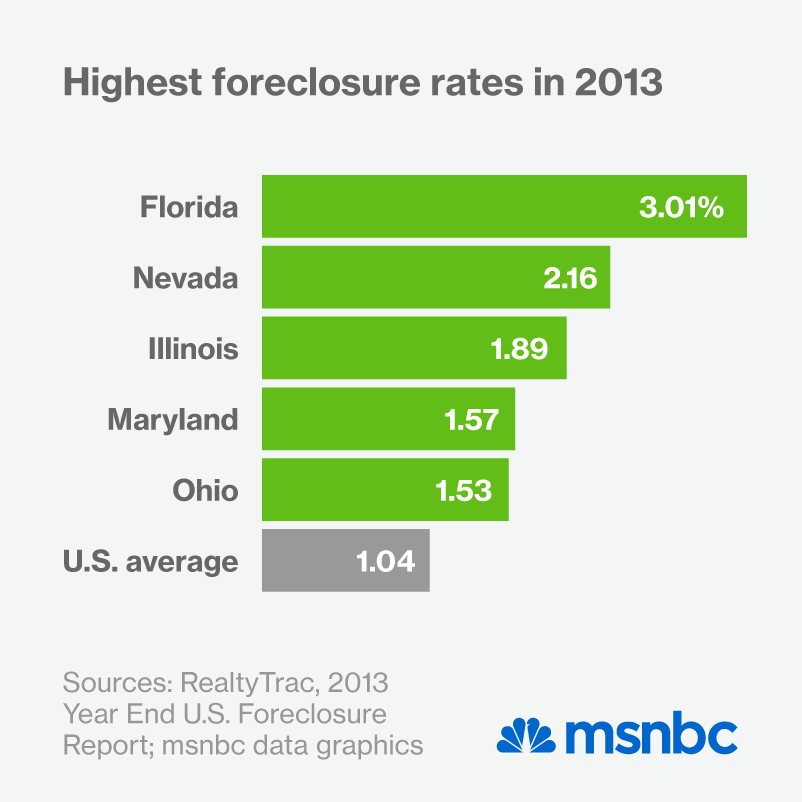

Last year, Maryland’s foreclosure rate was the fourth-highest in the country, behind Florida, Nevada, and Illinois, according to foreclosure-tracking firm RealtyTrac.

Nationally, the firm estimates, 5.2 million foreclosures have been completed since 2007. But the vast majority happened in the early years of the recession, with 2013’s foreclosures making up just 9% of the U.S. total. In Maryland, by contrast, last year’s completed foreclosures made up a whopping 15% of the five-year total.

“Many states are not completely out of the woods when it comes to cleaning up the wreckage of the housing bust,” Daren Blomquist, vice president at RealtyTrac, said in February.

Maryland’s high foreclosure rate is actually linked to the state’s attempt to remedy the process for underwater homeowners. In 2010, the state passed a law requiring mediation if homeowners requested it, and some foreclosure cases from early in the housing meltdown are only now going through the program.

Consumer advocates believe such reforms are an important backstop against abusive practices that abruptly forced people out of their homes. But the protracted process has also prolonged the uncertainty for some underwater homeowners who may lose their homes anyway.

“When we see someone who defaulted in 2010 or 2011, there’s a 99.9% chance we’re not going to be able to help them save their house—they can’t make up the arrears,” says Susan Francis of Maryland Volunteer Lawyers Service, which provides pro-bono legal aid. “Clients live with the foreclosure hanging over their heads, and every day they’re wondering whether it’s going to be the day they’re not going to live in their homes anymore.”

What’s more, mortgage servicers have continued to employ shoddy and abusive practices to prolong the pain and uncertainty. And new regulations intended to curtail such abuses have only just begun to take effect.

For the Moodys, it’s been a Kafkaesque ordeal. A decade ago, Paul got a 30-year adjustable rate mortgage with an interest rate that started at 6.88%, but which could go as high as 13.38%; he refinanced in 2006 for a 6.25% rate. Owned by Freddie Mac, the loan was first serviced by IndyMac, the infamous subprime lender, then moved over to OneWest Bank when IndyMac collapsed in 2008.

After he missed a mortgage payment in February 2009, Paul said he immediately offered to make up the difference. “I called them up and said, ‘I screwed up, I got the money. Do you want one check or two?’” OneWest told him he qualified for a hardship loan modification, with lower rates and more affordable payments. He took up the offer and made his trial payments—only to be told months later that his modification was denied and that couldn’t go back to the original terms of his loan, he says.

The runaround has never stopped. Every time they finished one application to re-establish the terms of their loan, the Moodys say they were told the necessary paperwork was missing or needed to be updated. In the middle of everything, Paul and Kim’s twin girls were born, and medication complications kept them shuttling back and forth to the hospital in 2010. “When [the twins] finally got home, and we thought, ‘They’re here, life is starting to resume,’” Paul remembers. “That’s when the craziness of the house and all the other stuff started to get worse.”

Attempts to seek relief from state and federally backed programs went nowhere. Cars would pull up to the house to take photos for a foreclosure sale. One time, Paul literally rushed passed the auctioneer on the courthouse steps and convinced the judge to stop the house from being sold off that very day.

For a fleeting moment last year, there seemed to be a breakthrough: In March 2013, a OneWest representative called to tell him that his loan modification had been accepted, Paul recalls. Then she corrected herself and said their house was going to be foreclosed upon anyway.

“All in the same conversation,” he says.

***

This sort of thing wasn’t supposed to keep happening.

The Dodd-Frank Wall Street Reform Act that passed in 2010 included new regulations intended to stamp out shoddy mortgage practices and spare homeowners like the Moodys some of the pain. It also aims to crack down on subprime loans by forcing lenders to employ stricter and more transparent practices.

But the complex new laws and intense lobbying have dragged out the implementation process. The major rules for mortgage servicers only went into effect in January 2014, allowing many abuses to continue despite intense scrutiny and demands for reform at the height of the housing meltdown.

%22They%20wear%20you%20down%2C%20you%20just%20give%20up%20and%20surrender.%20Then%20they%20have%20the%20house.%20And%20then%20they%20flip%20the%20house.%22%20%0D%0A%22′

Those include federal rules that are supposed to outlaw some of the very abuses that have been plaguing the Moodys. For instance, servicers are now prohibited from “dual-tracking” homeowners by offering them a loan modification while moving forward with foreclosure at the same time—something Paul says he’s experienced twice already.

Mortgage companies are also supposed to ensure their customer representatives can actually answer questions and access relevant documents to cut down on the red tape, mixed messages, and unreturned phone calls. Washington’s new rules are intended to build upon 2012’s national mortgage settlement, which ordered five of the country’s biggest banks and servicers to eliminate major foreclosure abuses.

But it’s unclear if and when such rules will reform the industry and how they’ll be enforced. Right now, federal regulators are simply counting on mortgage companies to make a “good faith effort” to comply with them, as Consumer Financial Protection Bureau deputy director Steven Antonakes told the Mortgage Bankers Association in late February. The agency will continue to conduct routine examinations of mortgage servicers, as they’ve now done for years. (The CFPB declined to comment for the story.)

As scrutiny has grown, however, the mortgage industry has simply adapted accordingly. But as rules on big banks tightened, they’ve also unloaded some of their most troubled mortgages on less tightly regulated entities.

Last summer, OneWest sold $2.5 billion in mortgage servicing rights—including the Moodys’—to Ocwen, a firm that’s grown tremendously by scooping up troubled assets from the housing crisis. But Ocwen has already landed in trouble with federal regulators for perpetuating some of the same abuses that created so much misery during the height of the meltdown.

In December 2013, the CFPB reached a $2.1 billion settlement with Ocwen after having found the company routinely “violated federal consumer financial laws at every stage of the mortgage servicing process,” CFPB director Richard Cordray said at the time. He described how the firm misled customers, took advantage of servicing shortcuts, and rejected loan modifications even when homeowners were eligible. An independent monitor will oversee the firm’s progress for three years, and the settlement money will go to principal forgiveness for delinquent borrowers.

But the new rules won’t give the Moodys back the years they’ve already lost to the battle. And the CFPB’s actions have yet to change the couple’s own dealings with Ocwen, and Paul doubts anything will change—or that he’ll see any of that settlement money.