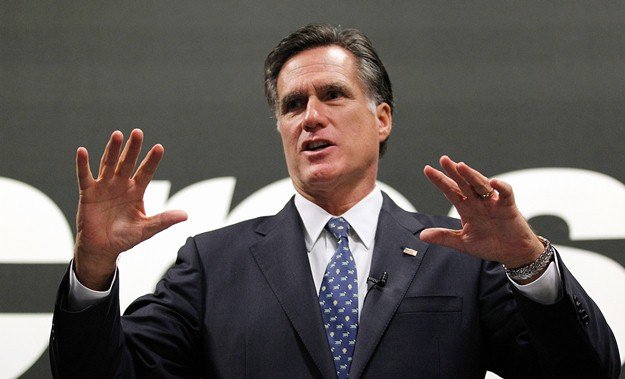

This could be explosive: Mitt Romney has millions of dollars of his personal wealth in investment funds set up in the Cayman Islands, a notorious Caribbean tax haven, according to ABC News.

As one of the wealthiest candidates to run for president in recent times, Romney has used a variety of techniques to help minimize the taxes on his estimated $250 million fortune. In addition to paying the lower tax rate on his investment income, Romney has as much as $8 million invested in at least 12 funds listed on a Cayman Islands registry. Another investment, which Romney reports as being worth between $5 million and $25 million, shows up on securities records as having been domiciled in the Caymans.

Official documents reviewed by ABC News show that Bain Capital, the private equity partnership Romney once ran, has set up some 138 secretive offshore funds in the Caymans.

A spokesperson for the Romney campaign told ABC News that Romney follows all tax laws and he would pay the same in taxes regardless of where the funds are based. Tax experts agree that Romney remains subject to American taxes.

But they say the offshore accounts have provided him — and Bain — with other potential financial benefits, such as higher management fees and greater foreign interest, all at the expense of the U.S. Treasury. Rebecca J. Wilkins, a tax policy expert with Citizens for Tax Justice, said the federal government loses an estimated $100 billion a year because of tax havens.

It may be legal, but is it fair? And shouldn’t the American people have the full story?

In 2008, President Obama released six years of tax returns. John McCain released two years.